Dogecoin Price Prediction: DOGE Pulls Back After 70% Monthly Rally, $0.25 Support Critical

DOGE Rally Slows Down

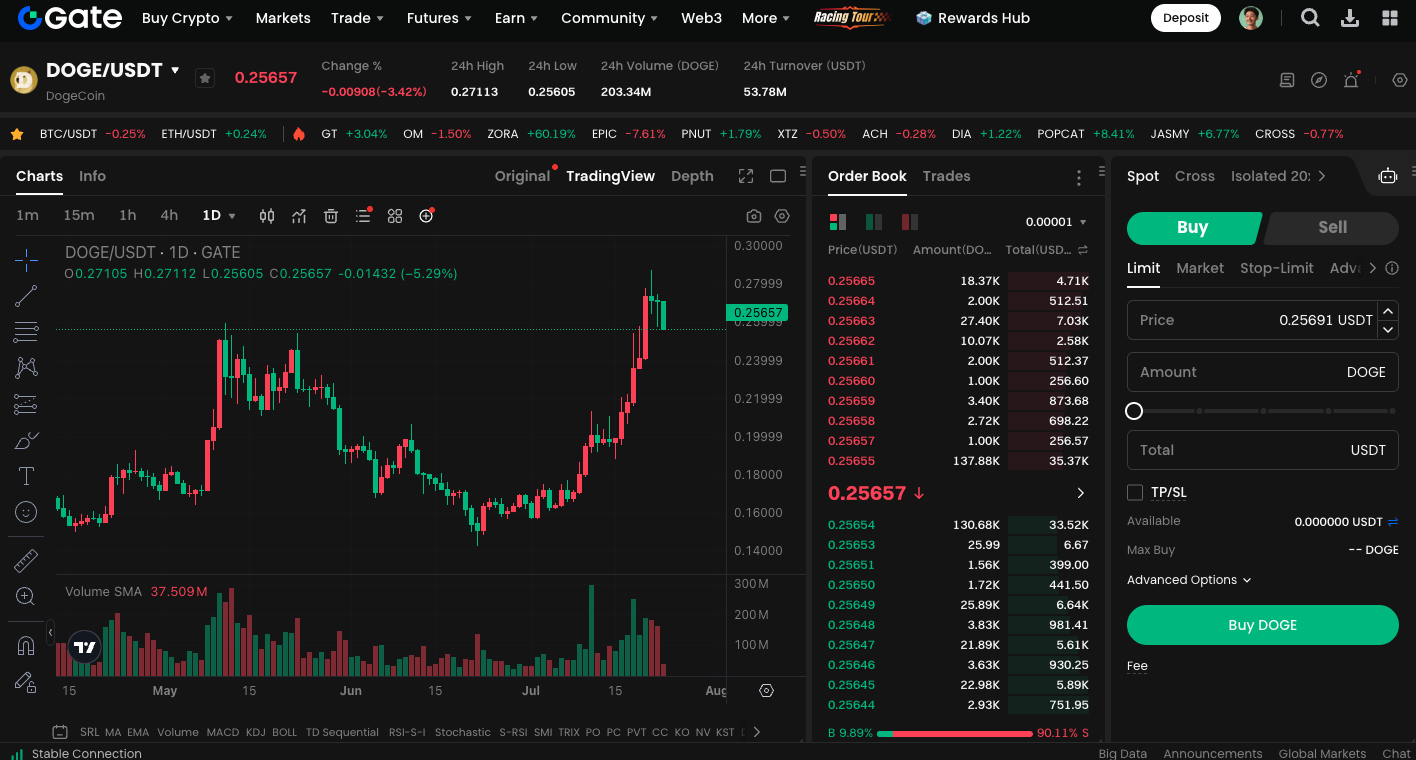

Following several weeks of strong gains, Dogecoin (DOGE) is now showing clear signs of a pullback, drawing significant attention to its short-term prospects. DOGE currently trades around $0.257. It is up 70% over the past 30 days. However, recent technical indicators suggest it has entered overbought territory, signaling increased risk of a correction.

DOGE Technicals Turn Bearish

Technical charts show DOGE’s Relative Strength Index (RSI) recently spiked above 80, indicating the market is overheated. In the near term, $0.25 serves as a key support level. If DOGE breaks below this threshold, it could test support between $0.23 and $0.21.

Market Sentiment Weakens Slightly

DOGE’s price action closely tracks Bitcoin; as BTC dipped 1.8%, DOGE also fell by roughly 4%. Broader market sentiment is cautious, as daily trading volume increased only 3.4%, indicating buyers are adopting a wait-and-see approach.

Long-Term Uptrend Could Resume

Despite short-term challenges, DOGE has ended its six-year downtrend in the long term. If it can hold above $0.25 and reclaim $0.28, the next targets are the key psychological levels at $0.30 and potentially $0.40.

Key Price Levels to Monitor

- A pullback to the $0.23–$0.21 range could present strategic buying opportunities.

- A decisive break above and hold of $0.28 could signal a renewed bullish trend.

- BTC’s overall trend is a key indicator of DOGE’s ability to sustain upward momentum.

Trade DOGE spot: https://www.gate.com/trade/DOGE_USDT

Summary

After a substantial rally, Dogecoin (DOGE) is now overbought according to technical indicators and faces possible correction pressure. In the short term, $0.25 is a critical support level. If DOGE holds this price, it may continue its upward trajectory.