How does Berachain V2 proposal improve $BERA value capture?

Original article title: “Up 30%: How the Berachain V2 Proposal Unlocks $BERA’s Value Capture?”

The crypto market is showing signs of recovery, with BTC and ETH leading the upward trend. Yet the native tokens of many Layer 1 blockchains haven’t kept pace, which is a stark contrast to the days when every chain competed to surpass Ethereum as the primary “Ethereum killer.”

Today, most L1 projects are grappling with the same core issue: their native tokens are becoming marginalized. Token unlocks, dilution, and a lack of compelling narratives have left these assets struggling to capture ecosystem-driven value.

Berachain, a novel EVM-compatible blockchain, stands out in the L1 landscape with its distinctive Proof of Liquidity (PoL) mechanism. However, the three-token model has restricted value accrual for its native token, $BERA, which currently holds a market cap of just $270 million.

$BERA faces challenges that go beyond traditional tokenomics—such as unlock pressure—and stem from weak narrative and underdeveloped product use cases.

If $BERA were only a gas payment token, its story would have little room to grow. However, a recent proposal for PoL V2 in Berachain’s official community may create a pivotal turning point for both the narrative and utility of $BERA:

By reallocating 33% of PoL incentives, the proposal aims to reposition $BERA from a sidelined gas token to the core yield-generating asset of the ecosystem.

After the proposal’s publication on July 15, $BERA’s price jumped 23% in just 24 hours, breaking above $2.50. The market interpreted and responded to the news as a significant bullish catalyst.

But beyond this short-term rally, can PoL V2 deliver sustained value for $BERA? Can it reshape the main token’s status through incentives and attract both institutional and retail participation?

PoL V1: The Hidden Pitfalls of $BERA Value Capture

Answering these questions requires a closer look at $BERA’s position under Berachain’s current Proof of Liquidity framework.

Berachain’s initial PoL (V1) is an economic consensus design, rewarding liquidity providers (LPs) and dApp builders to drive both network security and ecosystem growth.

Unlike standard Proof of Stake, PoL leverages a three-token system ($BERA, $BGT, $HONEY), allocating block rewards via “bribes” auctions to validators and ecosystem participants.

In this model, $BERA is the gas and base network asset, $BGT handles governance and staking rewards, and $HONEY—Berachain’s stablecoin—underpins liquidity.

Since mainnet launch on February 6, 2025, PoL initially fueled sharp growth in Berachain’s TVL, peaking at $3 billion at the end of March 2025.

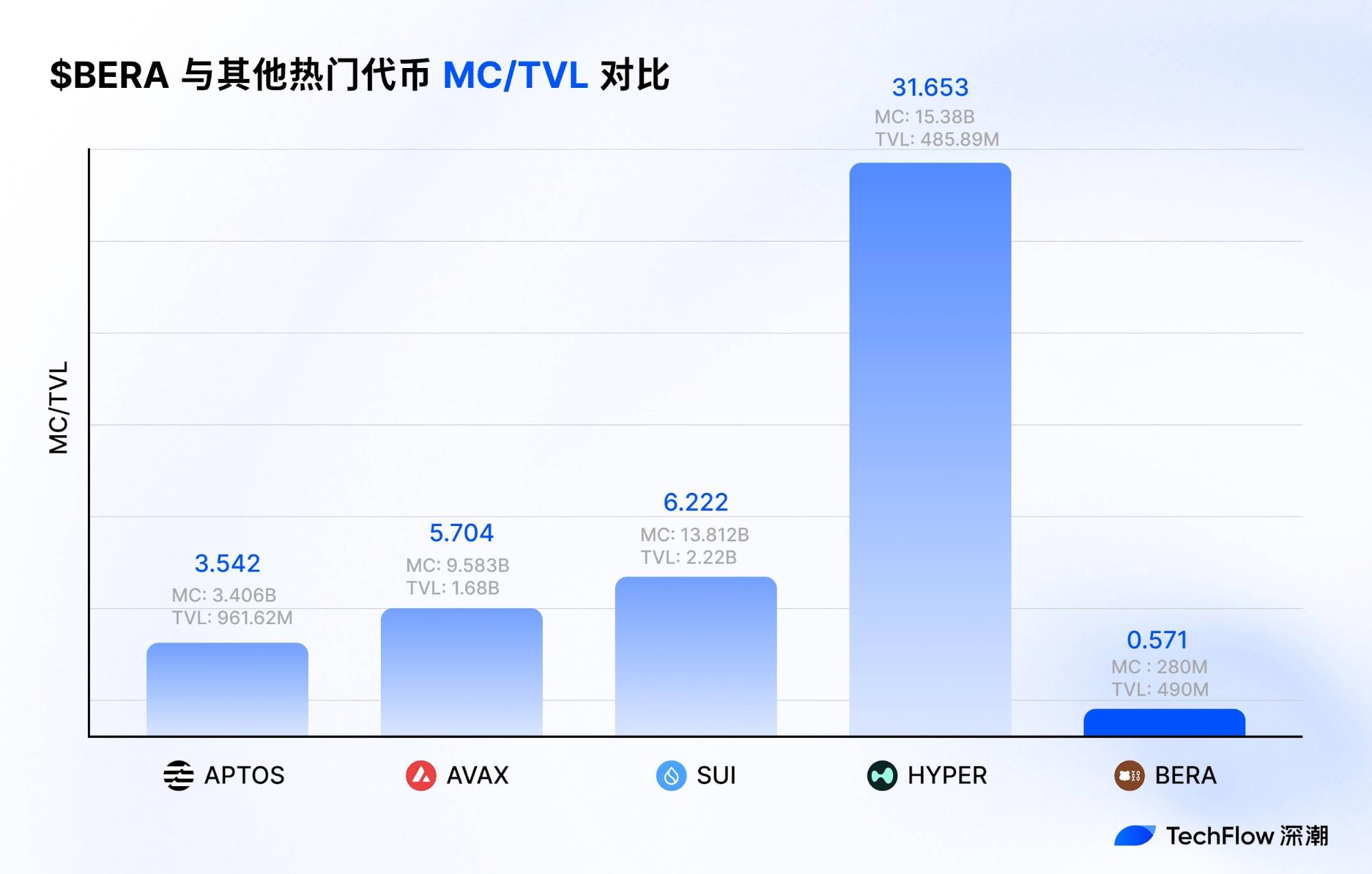

Despite this, the native token $BERA’s market cap was only $900 million at its height, producing an MC/TVL ratio below one-third. This shows $BERA has struggled to translate ecosystem growth into market value.

The root cause can be identified as follows.

Examining PoL’s original design reveals it prioritized the collective ecosystem over the native token. The structure of rewards and restrictions diluted $BERA’s value accrual.

V1’s sophisticated bribe auction and emissions design boosted ecosystem activity, but $BERA as the main asset didn’t get equivalent opportunities. The issues included:

- LPs captured all staking rewards through bribe incentives paid in $BGT, while $BERA was used solely for gas payments, lacking any direct yield mechanism.

- Bribe incentives mainly benefitted $BGT holders, leaving $BERA stakers with little reason to participate and depressing demand for the main token.

- PoL V1’s rewards pool focused liquidity incentives on dApps, not on the core on-chain asset $BERA.

In summary, while Berachain’s ecosystem and meme culture thrived, $BERA itself lagged behind. Elevating the main token’s status is now essential for boosting the chain’s overall influence.

The V2 Proposal: Making $BERA the Core Yield Asset

Having identified how PoL V1 limited $BERA’s value capture, let’s look at what’s new in PoL V2.

In essence, PoL V2 focuses on rebalancing incentives and expanding utility, with the intent to transform $BERA from a marginalized gas token into the ecosystem’s principal yield asset.

Key upgrades in PoL V2 include:

- Incentive Redistribution:

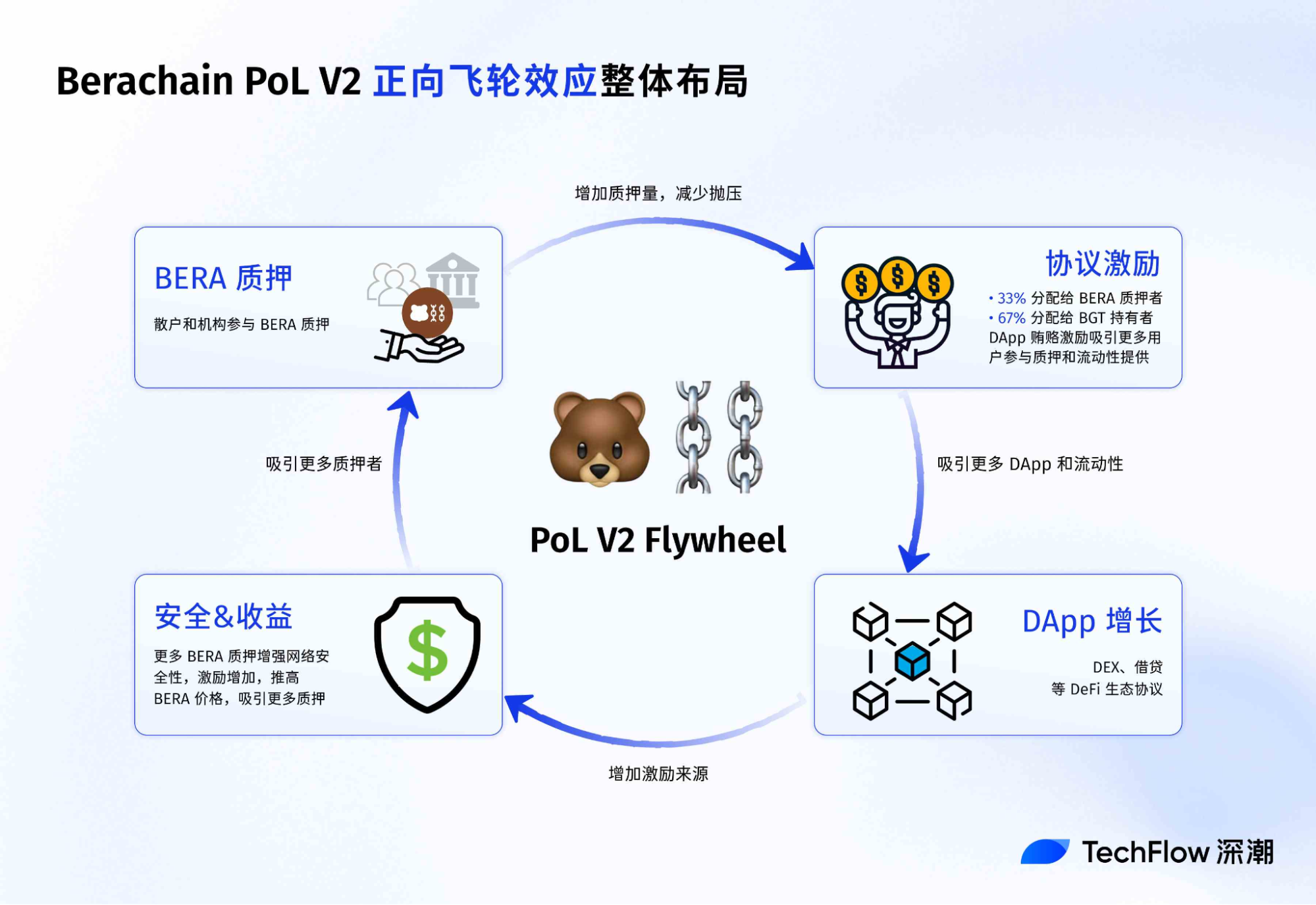

PoL V2 reallocates 33% of dApp bribe incentives from $BGT (governance token) holders to $BERA stakers.

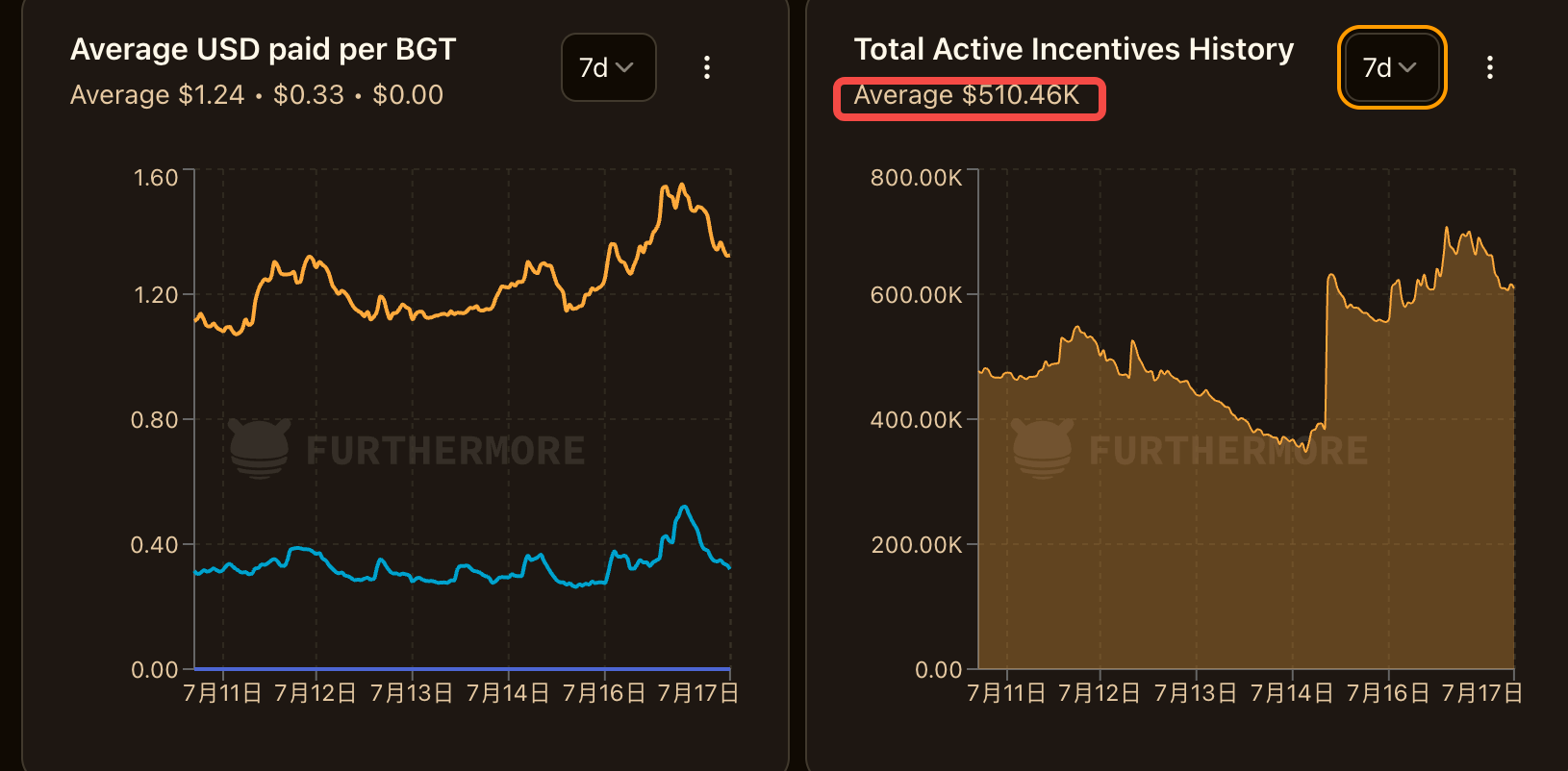

According to furthermore data, Berachain has distributed roughly $500,000 per day in total incentives over the past week, so a third (about $150,000 daily) will be added directly to the $BERA staking pool—applying constant buy-side pressure to $BERA.

The remaining 67% of rewards still flow to $BGT holders, sustaining leverage and incentivizing liquidity so as not to disrupt current stakeholder benefits.

Notably, this mechanism offers new yield to $BERA holders without simple inflation—by redistributing protocol cash flows, it sidesteps inflation risk for $BERA.

- Functional Module Expansion:

PoL V2 enables liquid staking tokens (LSTs), allowing $BERA stakers to earn validator rewards while using their staked tokens to capture even more PoL yield. This dramatically boosts $BERA’s capital efficiency.

Now, $BERA stakers can earn yield directly from protocol rewards (like on BEX) without complex DeFi strategies or the need to hold $BGT—lowering the barriers to entry.

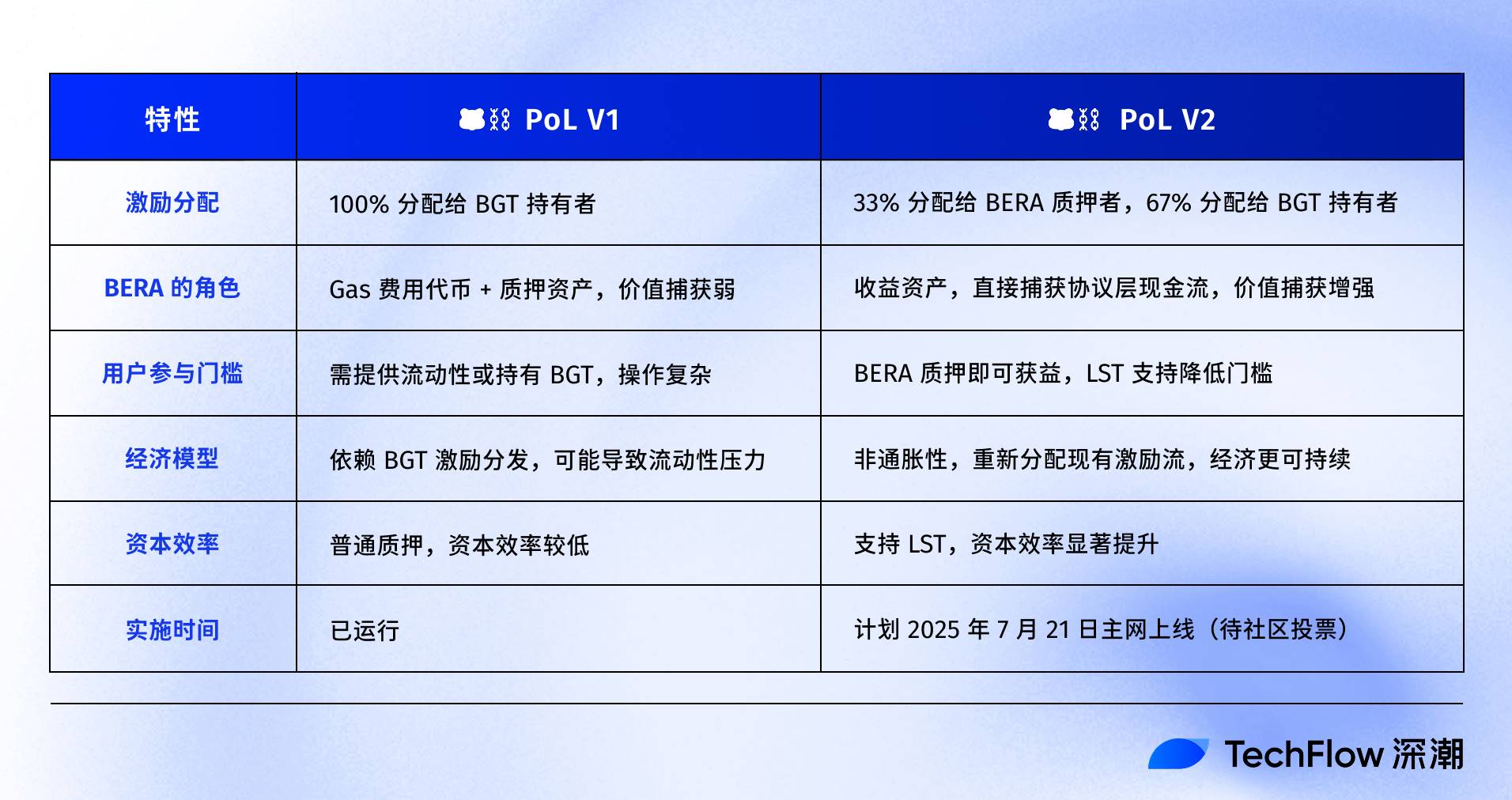

The following table compares PoL V1 and V2:

In the V1 model, most rewards funneled to $BGT, leaving $BERA in a passive role—its value growth hinging on indirect ecosystem expansion.

By contrast, V2 puts $BERA at the heart of the system—streamlining rewards through new distribution rules and staking primitives.

Value Capture—What Does It Really Mean for $BERA?

“Value capture” is a crypto buzzword—but for $BERA, where is that value actually anchored?

As $BERA evolves from a simple gas token into the ecosystem’s key yield asset, its value proposition is shaped by both the project’s narrative and its structural incentives.

The core of PoL V2’s upgrade is this: $BERA will now directly participate in protocol-level cash flow. $BERA gains a function like protocol dividends, fundamentally altering its valuation logic.

A brief calculation demonstrates the impact.

If the V2 proposal passes, 33% of dApp bribe incentives go to $BERA stakers. With daily incentives at $500,000, that’s $150,000/day—or about $1.1 million/week—now flowing to $BERA stakers.

This “protocol dividend” transforms $BERA into a genuine yield asset: holding $BERA lets you claim ecosystem-generated revenue, creating sustained buy pressure. Of course, factors like token unlocks, TVL growth, market adoption, and broader cycles will still impact price. But if $BERA offers productive utility beyond gas, it clearly has significant growth potential.

Compared to other public blockchains, $BERA’s MC/TVL ratio is notably compelling.

Furthermore, as a yield-bearing asset, $BERA could capture broader market interest.

Externally, companies like MicroStrategy have set a precedent for strategic crypto reserves with Bitcoin; others, like SharpLink, are accumulating ETH—recognizing its role as a yield-bearing asset.

Should PoL V2 establish $BERA as a source of non-inflationary, stable yield, it could pave the way for “token-equity” investment models.

Inside the Berachain ecosystem, PoL V2 creates a positive feedback loop:

— Staking rewards entice more long-term holders, increasing the token’s lock-up rate and reducing sell pressure.

— Stable $BERA prices and heightened network security encourage more dApp deployments, growing the pot for bribe incentives. The cycle continues: more protocol revenue for $BERA and $BGT holders spurs further growth—a staking-incentives–dApp growth flywheel.

For example, BEX (Berachain’s DEX) could see volumes surge as incentives increase, boosting demand for HONEY (the native stablecoin) and deepening ecosystem engagement.

Whereas most Layer 1s rely on inflationary token emissions to attract users, Berachain’s model closely mirrors protocol dividends, enhancing the ecosystem’s long-term resilience.

For different user types, PoL V2’s value-capture varies:

— For retail, $BERA staking offers a yield that is native to crypto and considered low risk—encouraging long-term holding.

— For DeFi strategists, LST support boosts capital efficiency and flexibility (e.g., providing liquidity on BEX with LSTs while earning PoL rewards).

— For institutions, $BERA’s yield-bearing, non-inflationary design presents a strategic reserve asset similar to stablecoins or high-yield bonds.

The current PoL V2 proposal was posted on Berachain’s public forum on July 15, 2025, with community feedback open until July 20, 2025.

Should the proposal pass a community vote, mainnet rollout is slated for July 21, 2025—at which point the shift in $BERA’s value capture will take effect.

It is important to note: the growth and appreciation of any chain’s token can’t be solved by a single proposal. As crypto matures, narratives alone won’t cut it—projects with strong fundamentals, real-world use, and sustainable revenue will win out in the long run.

As PoL V2 activates, a more vibrant ecosystem will drive higher $BERA yield—protocols bidding for $BGT will push up bribe rewards, further enhancing $BERA staking returns.

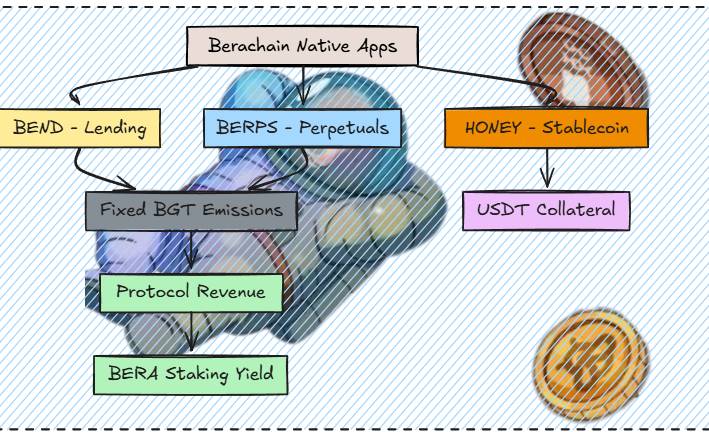

Expect a wave of native Berachain DeFi products: Bend (a lending protocol) launches in four weeks; Berp, a contract-based DEX, is confirmed and under development; HONEY will soon accept more collateral types, making it an even more powerful stablecoin (launching in three weeks).

(Image source: @0xRavenium)

Additionally, the new Berahub interface is now live with an upgraded UI, new portfolio dashboard, one-click vault operations, and an Explore page—making it easier for users to discover and participate in PoL yield opportunities beyond providing liquidity.

Project teams are clearly recognizing that a blockchain must first generate value for its core asset for the broader ecosystem to truly prosper.

By focusing on driving main token value through revenue, Berachain’s latest proposal sets a new industry benchmark.

Disclaimer:

- This article was originally published by [TechFlow], titled “Up 30%: How the Berachain V2 Proposal Unlocks $BERA’s Value Capture?” Copyright belongs to [TechFlow]. For reprint concerns, please contact the Gate Learn Team; we will handle your request promptly according to our standard procedures.

- Disclaimer: All opinions in this article are solely those of the author and do not constitute investment advice.

- The Gate Learn team translated other language versions. Unless Gate.com is explicitly referenced, these translations may not be copied, distributed, or used without permission.

Related Articles

Solana Need L2s And Appchains?

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?