When stablecoins set their sights on the payment market, can traditional payment giants still hold on to their throne?

Editor’s Note: Stablecoins have moved beyond the world of crypto trading and are quietly pushing their way into the broader payments market, carrying the potential to transform the infrastructure of financial systems. You may be curious: How will this emerging technology disrupt traditional payment ecosystems? This article examines how some players are partnering with card networks like Visa and Mastercard to embed stablecoin functionality within existing rails, while others are bypassing card schemes and banks to build entirely new payment systems. Examples at the forefront of this trend include PayPal’s PYUSD and the USDC payment solution rolled out by Shopify and its partners. Will stablecoins ultimately threaten the dominance of legacy payment giants, or give rise to an entirely new payments ecosystem? This article maps the forces driving the ongoing transformation in payments.

To date, stablecoins have seen their primary use case in cryptocurrency trading; however, blockchain technology and stablecoins are positioned to revolutionize traditional, complex financial systems such as securities markets and payment networks.

Over the past several years, stablecoins have made steady inroads into payment systems, generally following two paths: (1) adding stablecoin support to core card networks, and (2) seeking to bypass card networks and issuing banks altogether.

For the latter approach, PayPal’s PYUSD and Shopify’s joint USDC payment system with Coinbase and Stripe are leading examples. As the stablecoin sector matures, more large platforms with vast merchant and user bases are expected to launch proprietary payment systems—posing potential threats to both banks and card networks.

Stablecoin Usage Still Dominated by Exchanges

Source: BCG

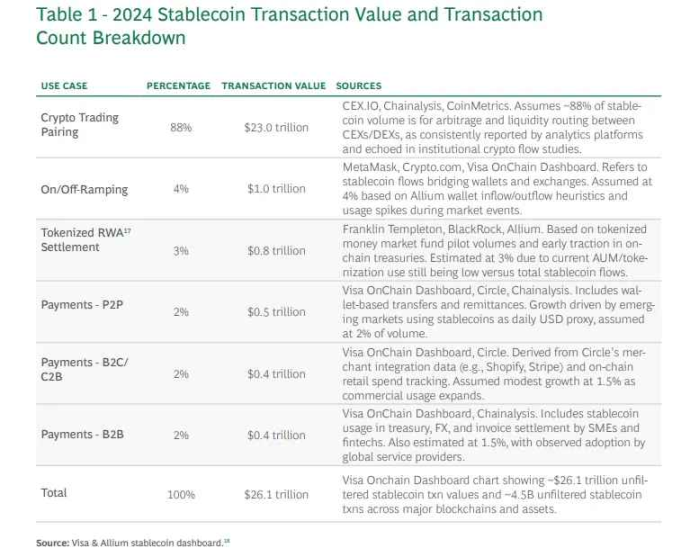

Both in the United States and globally, stablecoins are drawing increased scrutiny. Lively debate surrounds their potential to disrupt sectors such as remittances, payments, real-world assets (RWAs), and interbank settlement. Yet, according to a Boston Consulting Group (BCG) report, 88% of stablecoin trading volume in 2024 is still driven by crypto exchange activity. This underscores the current limits of stablecoin adoption; mainstream, real-world use cases have yet to materialize at scale.

Stablecoins: A Foundation for Structural Change in Finance

While fintech innovation has significantly improved the user experience, the back end of global finance remains hampered by legacy processes and inefficiency. Here, blockchain and stablecoins are poised to drive true structural innovation—not as mere extensions of today’s infrastructure, but as disruptive technologies with the potential to fully replace existing models, echoing previous historic inflection points in finance.

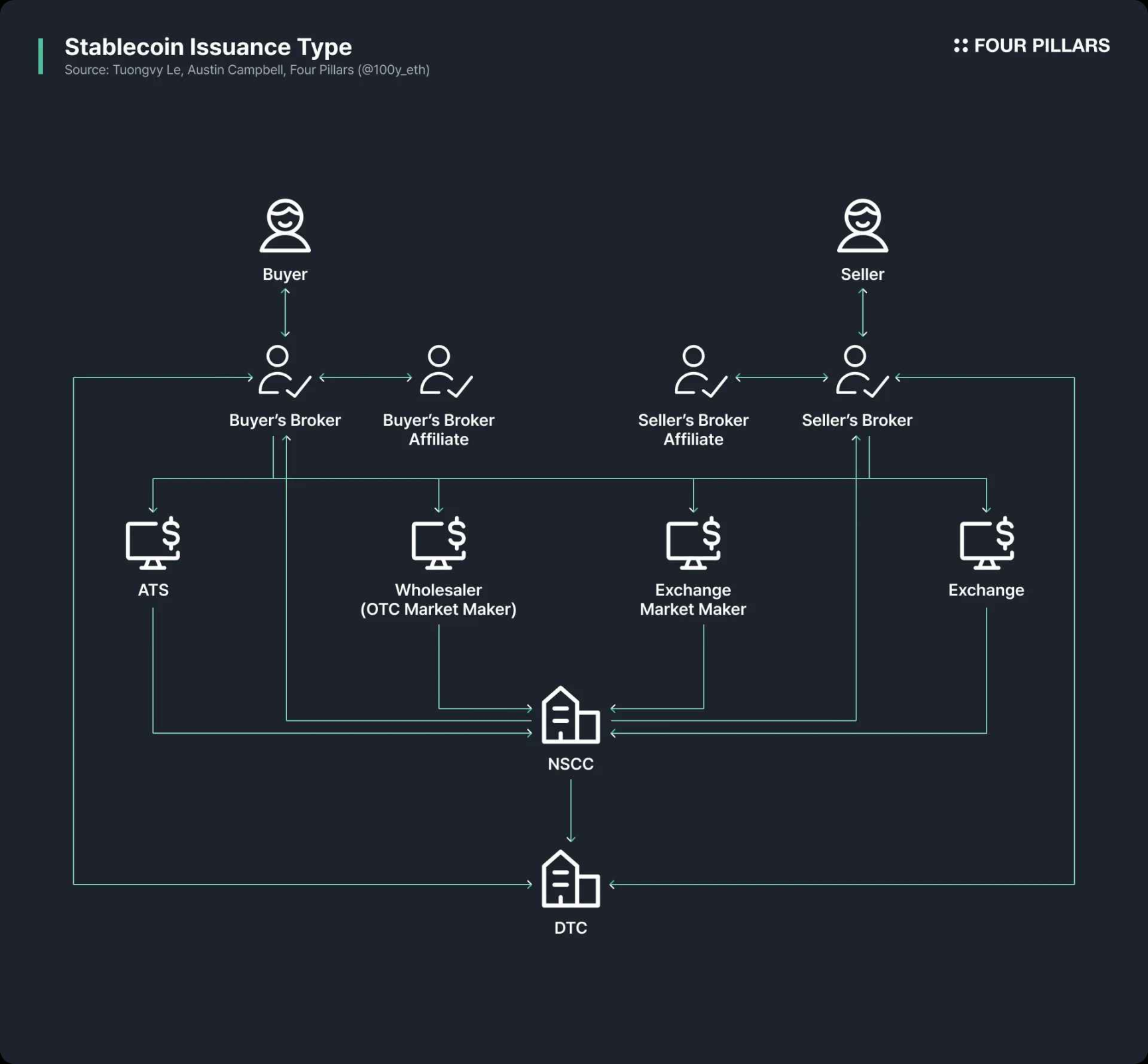

Securities Market

The complex back end of securities markets originated from the paperwork crisis that affected the U.S. industry in the 1960s and 1970s. At the time, securities were entirely paper-based, and explosive growth in transaction volumes nearly crippled the system. To address this crisis, Congress passed the Securities Investor Protection Act (SIPA) and amended the Securities Act, creating centralized clearing and indirect securities holding structures.

This overhaul digitized asset ownership and boosted settlement efficiency, but also entrenched a multitude of intermediaries—brokers, clearinghouses, custodians—driving up complexity and costs. The current system is largely the result of iterative policy compromises and technical constraints from a pre-blockchain era.

Cross-Border Remittances

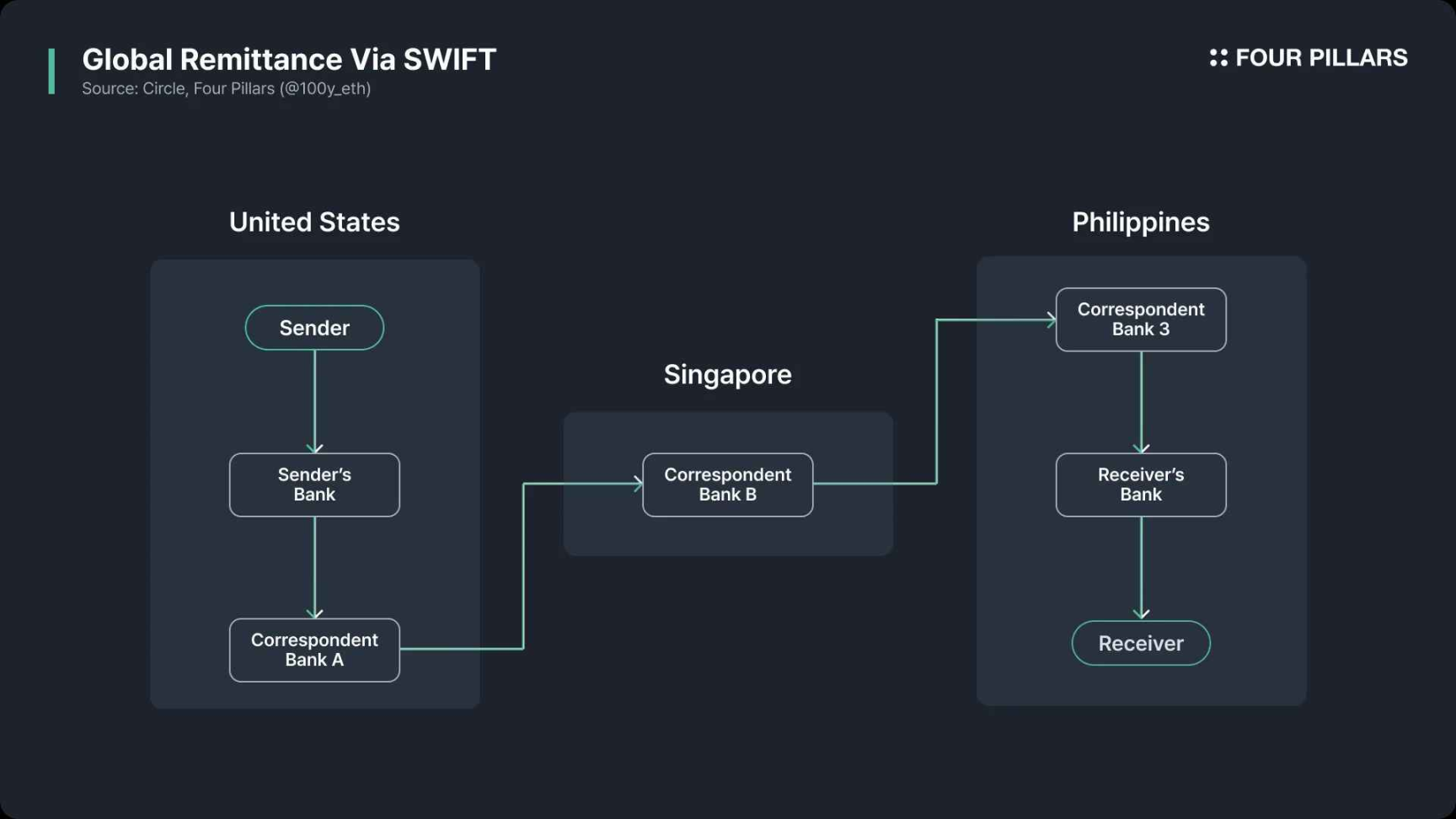

SWIFT, the Society for Worldwide Interbank Financial Telecommunication, is the world’s leading cross-border payments system. Established in Brussels in 1973 by 239 banks, SWIFT replaced legacy international bank messaging infrastructure that was slow, error-prone, and lacked common standards—resulting in inefficiency, incompatibility, and security risks. SWIFT’s mandate was to bring standardized, secure messaging to the industry.

Still, SWIFT merely handles messaging—actual fund transfers occur through networks of correspondent and central bank accounts, with settlements processed separately. Each intermediary introduces added costs and delays, thanks to fees, KYC/AML checks, currency conversion, time zone gaps, and holidays. As a result, cross-border payments remain slow and opaque. If blockchain and stablecoins had existed at the time, settlement and messaging could have taken place on a unified platform. This would have revolutionized efficiency and transparency.

Can Stablecoins Disrupt the Payments Market?

While stablecoins are often discussed as innovation drivers for securities and cross-border remittances, the most anticipated next-step use case is mainstream payments. Not only Web3 startups, but established players like Visa, Mastercard, Stripe, and PayPal are now racing to explore this territory.

To determine whether stablecoins can truly reshape the payments landscape, we must first understand how legacy payment systems work, identify their bottlenecks, and assess where stablecoins can offer improvements.

How Do Legacy Payment Systems Work?

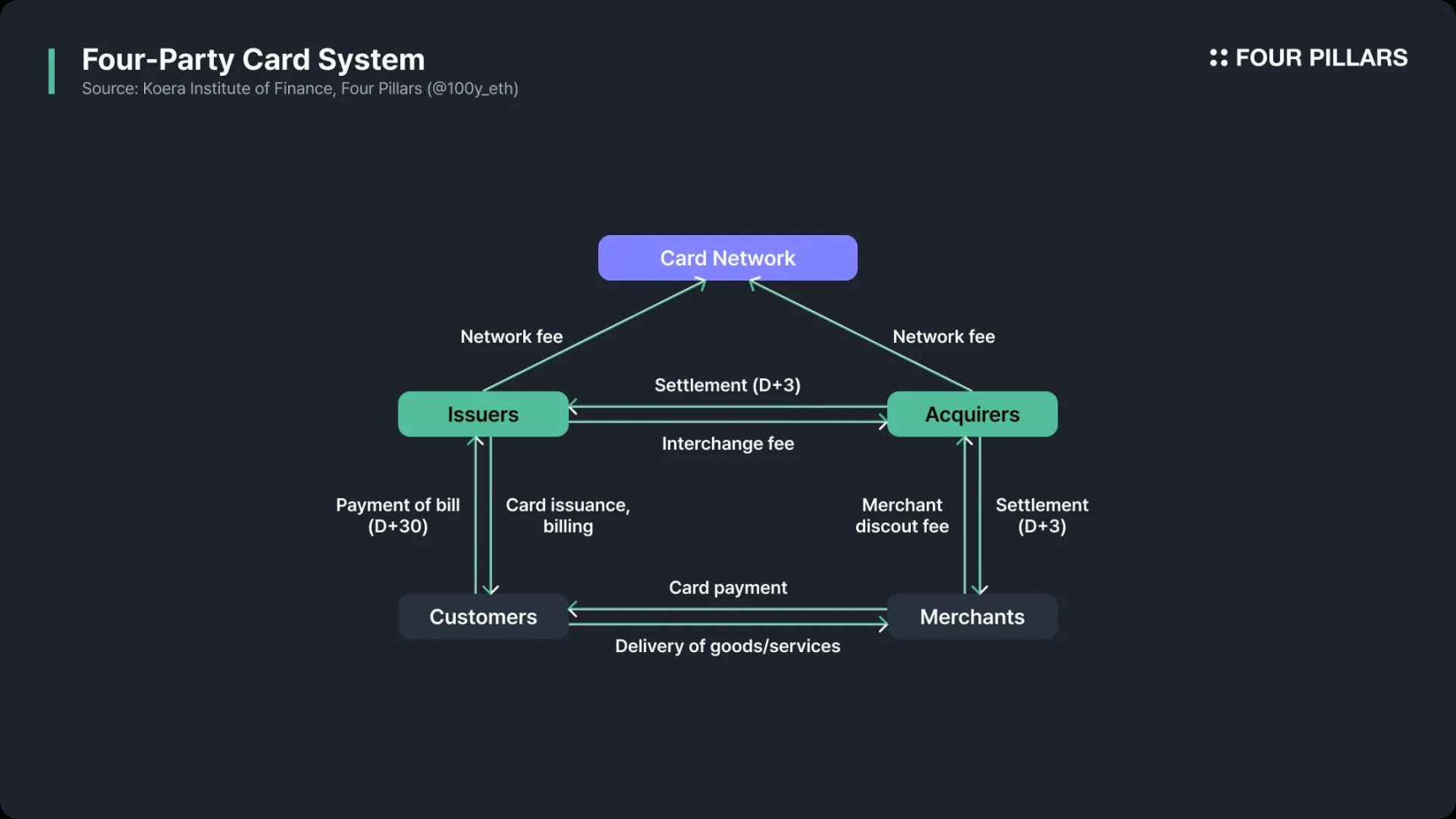

Here’s a high-level overview of the payment flow when a customer pays a merchant:

Authorization

- The customer initiates payment using a bank card.

- The POS (point-of-sale) terminal or online gateway sends an authorization request (carrying payment details) to the merchant acquirer.

- The acquirer relays this request to the card network (e.g., VisaNet, Mastercard Network).

- The card network forwards the request to the card issuer (customer’s bank).

Verification

- The issuer checks the card’s validity, account balance, credit limit, and for any suspicious activity.

- Approval or rejection returns through the card network to the acquirer.

- If approved, the purchase amount is temporarily held (“authorized”) in the customer’s account.

- If denied, the merchant receives the rejection and supporting reason.

Capture

- For certain industries—gas stations, hotels, online shopping—final amounts may only be confirmed post-authorization. The merchant sends a “capture” request to the acquirer for the final amount, marking transaction completion.

Batch Processing

- Authorized transactions are batched throughout the business day and sent to the acquirer after closing.

Clearing & Interchange

- The acquirer submits batched data to the card network.

- The network sends each transaction to the relevant issuer, calculates interchange fees, and manages clearing.

Settlement

- Funds transfer from the card issuer’s settlement account to that of the acquirer. The card network generates reports for each party, but actual money movement occurs via interbank settlement rails.

Funding

- The acquirer credits the merchant’s bank account (minus fees), generally via ACH or wire transfer.

Reconciliation

- Merchants reconcile the received deposits with their records, checking for discrepancies, omissions, or duplicate charges.

What Are the Drawbacks of Current Payment Systems?

High fees and slow settlement are the two most well-known pain points of legacy card networks. Are they unavoidable, or fixable?

Source: a16zcrypto

Payment Fees

Merchants face three main categories of fees in card payments:

- Interchange fees (the largest, collected by the card issuer)

- Network fees (charged by Visa, Mastercard, etc.)

- Acquirer markups (service fees from merchant banks)

Can blockchain and stablecoins bring costs down? First, there’s the opportunity to cut costs for cross-border payments. Traditionally, settlements between merchants and cardholders in different countries must route through SWIFT. Using blockchain or stablecoins can bypass this legacy infrastructure and reduce costs substantially.

Second, costs can be reduced by bypassing card networks and issuing banks entirely. Card networks act as communication layers between customer and merchant banks, but stablecoin-based payments can, in theory, move funds directly—wallet to wallet—on a blockchain network.

Settlement Speed

Card payment authorization is nearly instantaneous, a benchmark that public blockchains currently struggle to match in scale. In the card system, however, clearing and settlement typically take 1–2 days for clearing and 1–5 days for actual settlement.

Many factors drive settlement delays—some can be resolved; some cannot:

- Clearing cycles: Card payments are batched and cleared daily; blockchain-based systems are not so restricted.

- Disputes, chargebacks, cancellations, and refunds: These will continue to delay settlement, regardless of technology.

- Cross-border payments: Must still clear through SWIFT, creating additional lags. Blockchain has a genuine advantage here.

Stablecoin-Based Payment Systems

More financial institutions and corporates are now piloting or deploying stablecoin-based payment network solutions. This transformation is unfolding in two primary ways: (1) card networks like Visa and Mastercard lead efforts to weave stablecoins into legacy rails; (2) other providers aim to bypass these networks altogether.

Stablecoin Payments Integrated with Card Networks

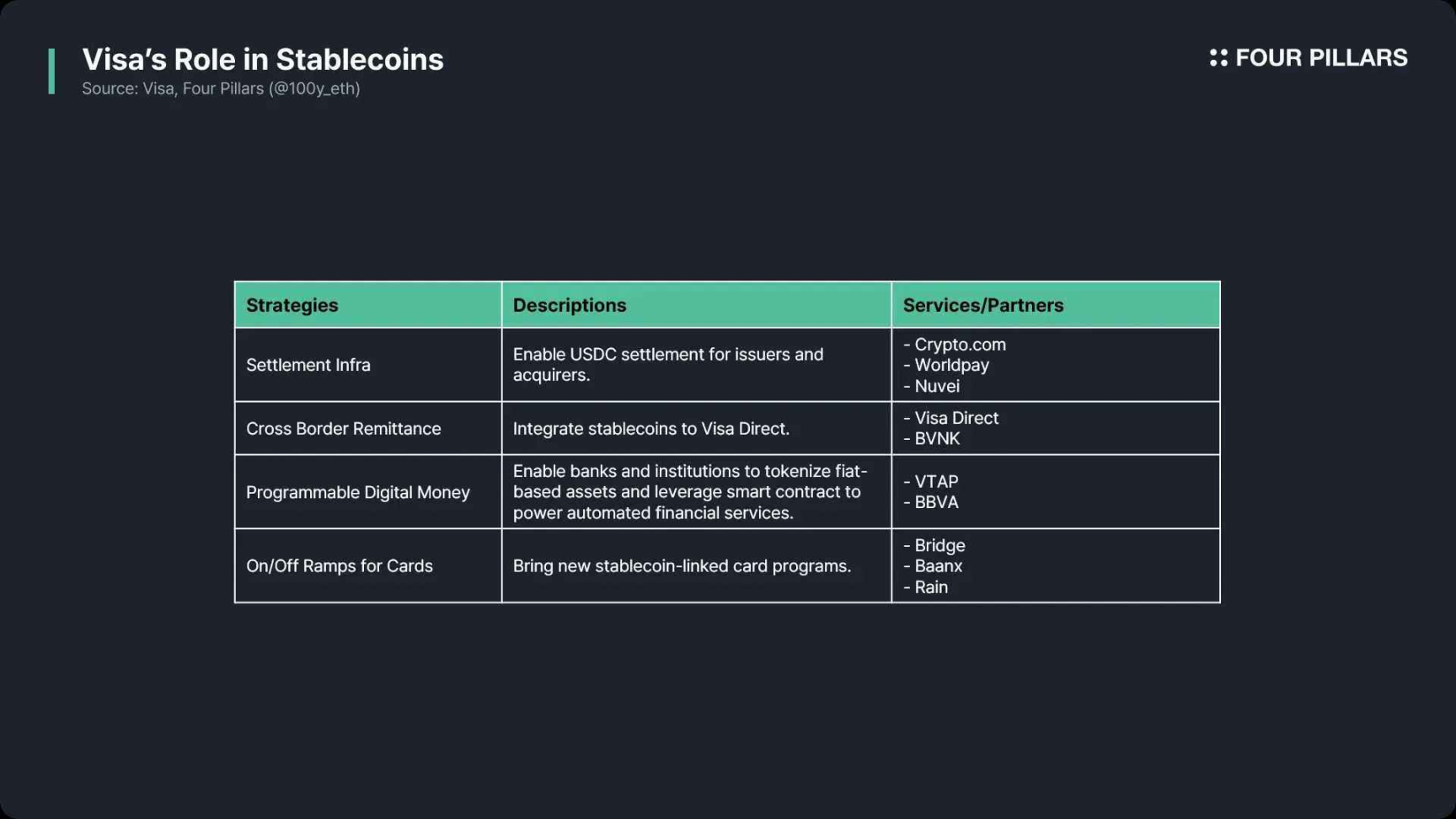

As outlined in my previous analysis, Visa and Mastercard are actively working to embed stablecoin rails into their core infrastructure.

- Crypto debit cards: These products let customers pay with stablecoins residing in Web3 wallets or custodial exchange accounts. The card issuer can either convert the stablecoins to fiat currency and process them on legacy rails, or pass stablecoins directly to the card network for settlement alongside conventional card transactions.

- Stablecoin settlement: As discussed, card networks can receive stablecoins into settlement accounts or use them to settle with acquiring banks.

Essentially, stablecoin integration on card networks adds support for stablecoin payments and settlement, but doesn’t change the core participants or architecture. The primary benefit is convenience for those already using stablecoins, as it eliminates the friction of converting between fiat and stablecoins. If the entire transaction chain runs in stablecoins, especially for cross-border commerce, efficiency is greatly improved.

Bypassing Card Networks and Issuing Banks

Meanwhile, some payment service providers are bypassing Visa, Mastercard, and similar networks entirely by processing payments directly with stablecoins. Notable use cases include PayPal’s PYUSD and Shopify’s USDC solution developed with Coinbase and Stripe.

PYUSD Payment Solution

PayPal users can spend PYUSD directly within the app. Unlike cryptocurrency wallets, PYUSD is custodied by Paxos, its issuer, on users’ behalf. When you pay with PYUSD, there is no on-chain movement; PayPal simply updates internal ownership records. If the merchant wants fiat currency, PayPal swaps PYUSD for USD at par and pays out via ACH or other bank rails.

If a user’s PYUSD balance is insufficient, they can top up using a bank account or card (fees may apply); likewise, merchants opting for fiat currency settlement incur normal banking costs and delays. But completing the full payment lifecycle in PYUSD eliminates card and bank intermediaries, reducing both friction and cost.

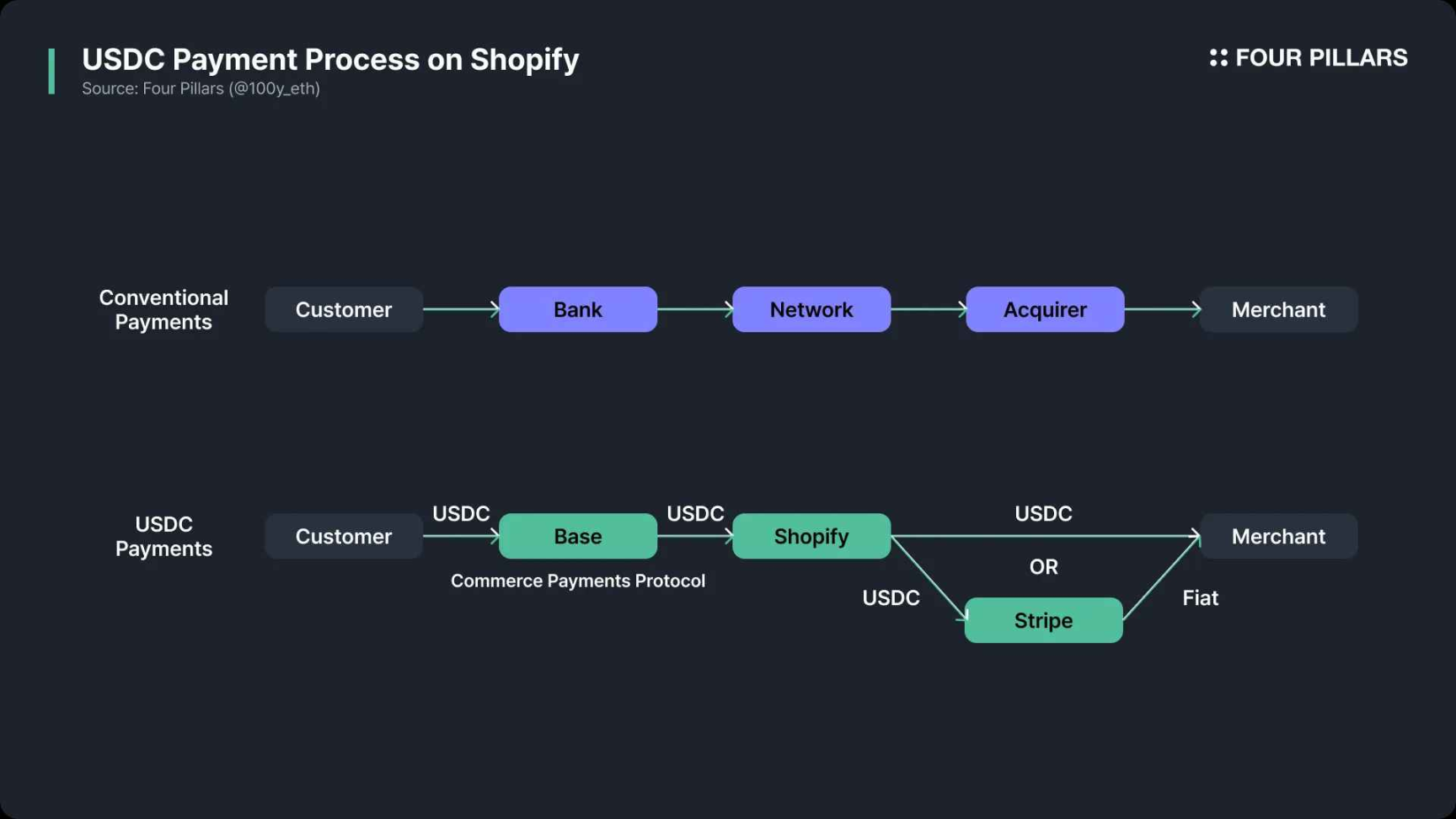

Shopify’s USDC Integration with Coinbase and Stripe

Unlike PayPal, where stablecoins are used off-chain within the provider’s ecosystem, Shopify’s new USDC flow operates natively on-chain.

In June 2025, Shopify announced a partnership with Coinbase and Stripe to add USDC payments to Shopify Payments. Customers can now check out using USDC-compatible wallets on the Base network, paying directly from self-custody.

The on-chain “Commerce Payment Protocol” on Base mirrors traditional card logic by authorizing payment before funds actually move, enabling merchants and Shopify/Coinbase to batch transactions for settlement later on the network.

By default, Shopify relies on Stripe to convert USDC to local fiat currency and pay out via ACH, SEPA, or other traditional rails. Merchants can also choose to receive settlement directly in USDC—for nearly instant, cryptocurrency-native payouts.

Summary and Outlook

The most common question surrounding stablecoin-based payments: “If blockchain transactions are inherently irreversible, how do you handle cancellations and refunds?” Even if payments become fully peer to peer, issues like fraud, chargebacks, and refunds remain—meaning intermediaries are still essential. The traditional roles of card networks and issuing banks won’t vanish entirely.

In both the PayPal and Shopify stablecoin examples, intermediaries such as PayPal and Stripe act as payment service providers, managing fraud screening, chargebacks, and refunds. PayPal settles PYUSD transactions off-chain, providing operational flexibility for dispute resolution. Shopify’s on-chain “Commerce Payment Protocol” introduces a delay after authorization to manage dispute windows. USDC issuer Circle has also launched a “Refunds Protocol” for decentralized dispute resolution in stablecoin payments.

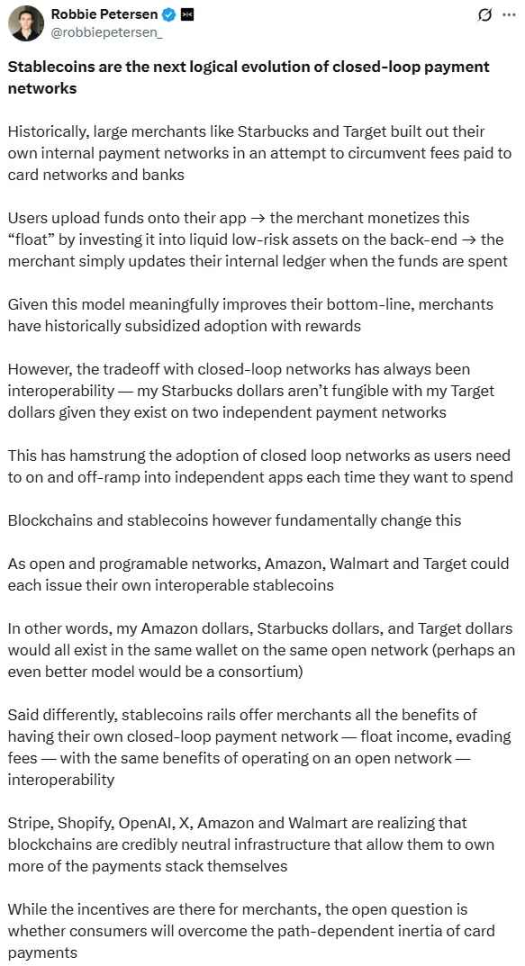

Source: X (@robbiepetersen_)

Stablecoin-based payments are rapidly becoming prevalent in the industry. Issuance is critical, but adoption and ecosystem development are just as vital. As Dragonfly’s Robbie Petersen notes, established networks with massive merchant and user footprints are poised to embrace stablecoin payment flows—bypassing card networks and banks. Stablecoins may soon enable interoperability between closed-loop payment ecosystems. Given this trajectory, stablecoins are set to pose real competitive threats to incumbent card networks and banks, driving them to explore new opportunities within the unstoppable stablecoin wave.

Disclaimer:

- This article is reprinted from Foresight News. All copyrights belong to the original author (100y). For any copyright concerns, please contact the Gate Learn Team, and we will respond in accordance with relevant procedures.

- Disclaimer: The views and opinions expressed herein are those of the author alone and do not constitute any investment advice.

- Other language versions of this article are translated by the Gate Learn Team. Without explicit permission referencing Gate, do not copy, distribute, or otherwise infringe upon these translations.