US regulators loosen up again, can mainstream crypto trading platforms return to the United States?

On August 28, the U.S. Commodity Futures Trading Commission (CFTC) delivered a major signal: Foreign Board of Trade (FBOT) guidance has provided the regulatory certainty needed for legal onshore trading. This opens a legitimate path for overseas exchanges—long excluded from the U.S. market—to return and operate legally.

In recent years, regulatory pressure has forced industry leaders like Binance and Bybit to restrict U.S. users or even exit the market entirely. As a result, countless American traders have been left with sparse options on domestic platforms or have risked accessing offshore services. Now, with clear direction from the CFTC, these platforms can register via FBOT and serve U.S. clients lawfully—without being required to convert into a “U.S. domestic exchange” (DCM).

Acting Chair Caroline D. Pham stated in the disclaimer that this initiative is “intended to bring trading activities that were pushed overseas back to the U.S.” Set against the Trump administration’s aggressive “Crypto Sprint,” this guidance acts as a rallying call, marking a clear and dramatic shift in America’s regulatory climate.

Why now?

In recent years, the U.S. stance on the cryptocurrency sector has been defined almost entirely by enforcement. Under President Biden, former SEC Chair Gary Gensler wielded an enforcement-first approach, making “regulation as punishment” his signature—turning giants like Binance and countless projects into targets. In 2023, Binance was hit with a $4.3 billion penalty and forced to fully leave the U.S. market, sending shockwaves throughout the industry.

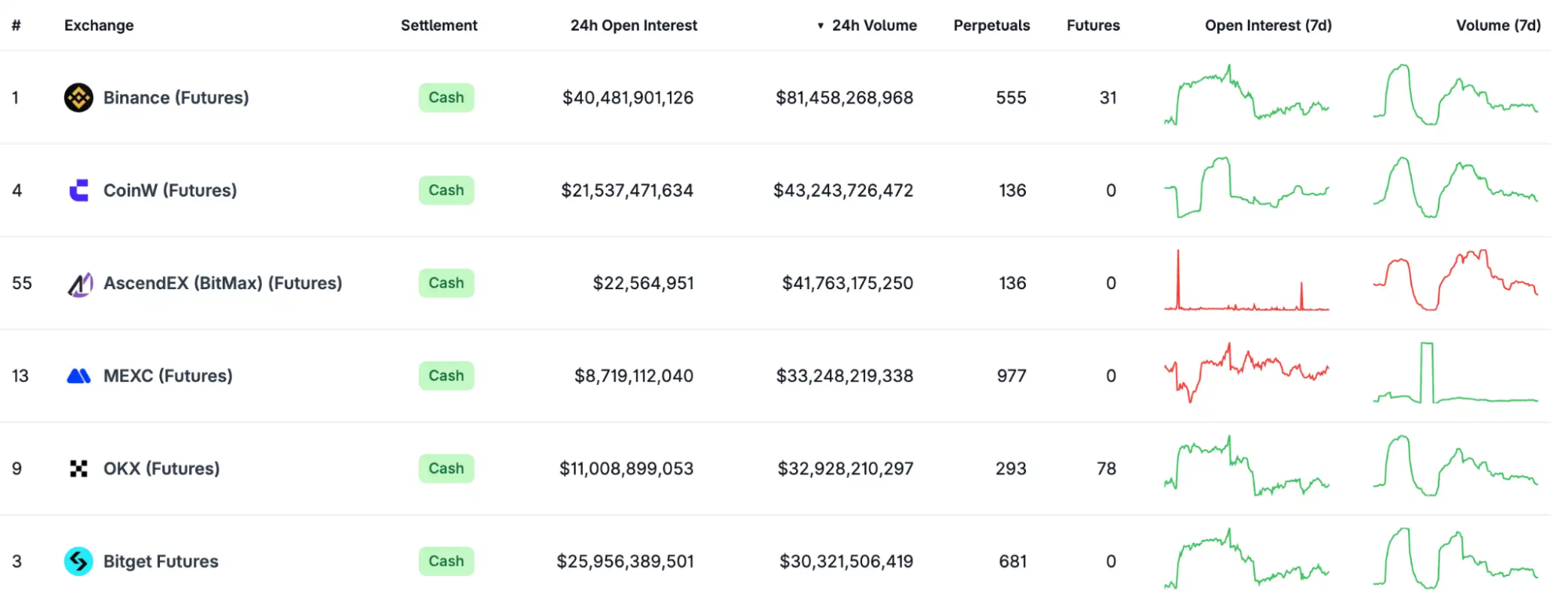

What the U.S. lost was far greater than just a few exchanges: a whole slice of the market vanished. Domestic users migrated offshore, followed by capital. Offshore platforms took the lead in derivatives, with daily volumes at Binance, OKX, and Bitget routinely reaching tens of billions, while domestic exchanges were sidelined—Coinbase’s daily derivatives trading volume is only $6 billion. Much of this lag comes from SEC-imposed restrictions on perpetual futures, staking, and leverage. Elsewhere, Singapore, Hong Kong, and the EU rapidly rolled out flexible regulatory frameworks, eroding the U.S.’s earlier “regulatory advantage.”

This makes the CFTC’s move especially timely. In early August, the CFTC kicked off the “Crypto Sprint,” asking for public input on whether spot crypto assets could be listed on registered exchanges (DCM). Within just weeks, the agency was inundated with questions about how foreign exchanges could lawfully re-enter the U.S. market. With mounting industry and public pressure, the CFTC had to deliver a clear answer.

Welcoming overseas exchanges not only corrects the “overregulation” of recent years but positions the U.S. to reclaim a share of the global market. Against the backdrop of the “Crypto Sprint,” this guidance is more than a procedural clarification—it’s an invitation to global competition: U.S. traders should stand alongside peers worldwide, enjoying the deepest liquidity and widest range of products.

The new compliance landscape: Return, Expansion, and Competition

The core impact of the CFTC’s FBOT guidance is that it brings American traders back into the main pool of global trading. Domestic exchanges, hampered by regulatory constraints, offered limited products and liquidity—forcing users into mediocre experiences or risky offshore alternatives. With a transparent compliance path, U.S. traders now gain access to deep liquidity and product diversity matching their Asian and European counterparts. This boosts market efficiency and means the U.S. can once again link up to the global financial ecosystem. Some analysts predict this could drive liquidity growth for Bitcoin and Ethereum in the coming months.

For overseas exchanges long excluded from the U.S., this functions as a long-awaited “passport.” Giants like Binance, Bybit, and OKX previously cut off access for U.S. users under heavy compliance demands. Now, they have a legitimate way to return. The enormous U.S. user base and strong trading appetite have always tempted these platforms, and the FBOT registration clearly unlocks lawful expansion. For exchanges, it’s a new channel for growth; for users, it means more entrants, lower costs, better products, and improved service.

This guidance also creates a fairer competitive landscape for domestic exchanges. In recent years, the U.S. crypto market has been essentially monopolized by a handful of platforms. With the FBOT registration pathway open, global leaders can now re-enter in full compliance. The market is no longer limited to domestic exchanges; it is now open to global competition. More contenders mean sharper pricing, faster product iterations, and elevated service standards. For U.S. investors, this is a significant benefit: they are no longer stuck with limited choices but can access leading global liquidity and innovation in an open, equitable environment.

Conclusion

This guidance not only clarifies procedures—it restores the image of American regulation. In recent years, U.S. policy has been seen as rigid, penalty-driven, and obfuscated—driving capital and project teams abroad. Now, the CFTC is showing it listens and responds quickly, correcting past excesses and signaling a move toward transparency and open rules. As the market absorbs this shift, investor and developer confidence will be rebuilt, attracting capital and innovation back to America. This is the true heart of the “Crypto Sprint”—not empty slogans, but real regulatory change.

Disclaimer:

- This article is republished from [BlockBeats]. Copyright is owned by the original author [kkk]. If you have concerns about this republication, please contact the Gate Learn team, which will handle the issue promptly as per applicable procedures.

- Disclaimer: The views and opinions stated in this article are those of the author alone, and do not constitute investment advice of any kind.

- Other language versions of this article are translated by the Gate Learn team. Unless explicitly referencing Gate, reproduction, distribution, or copying of the translated articles is strictly prohibited.

Related Articles

Solana Need L2s And Appchains?

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?