一、BTC机构价格结构分析与策略

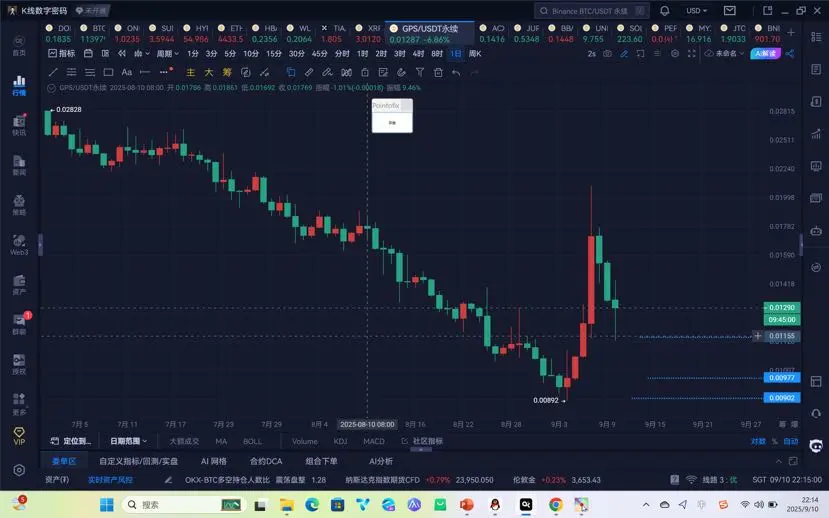

1.以BTC/USDT永续为例,当前主方向为空,考虑到价格结构未发生明显变化,仍维持前期观点不变,日线级别震荡下行,空方制约上限为128830;

2.近期空方压力位112585-113620,以下,高空为主,未进场者耐心等待反弹中1小时周期《机构强拐点模型》(此模型详细讲解可关注《K线数字密码》后回看直播视频)中空单交易机会。

3.110421以上,短期继续反弹,低多为辅,压力位附近不建议盲目追多;如站上112585则看高一线至113620,短期需调整做单思路和策略。108333以下,继续看跌,或产生新的价格结构,则多方反弹会随之而来,对ETH有牵引力。

二、ETH机构价格结构分析与策略

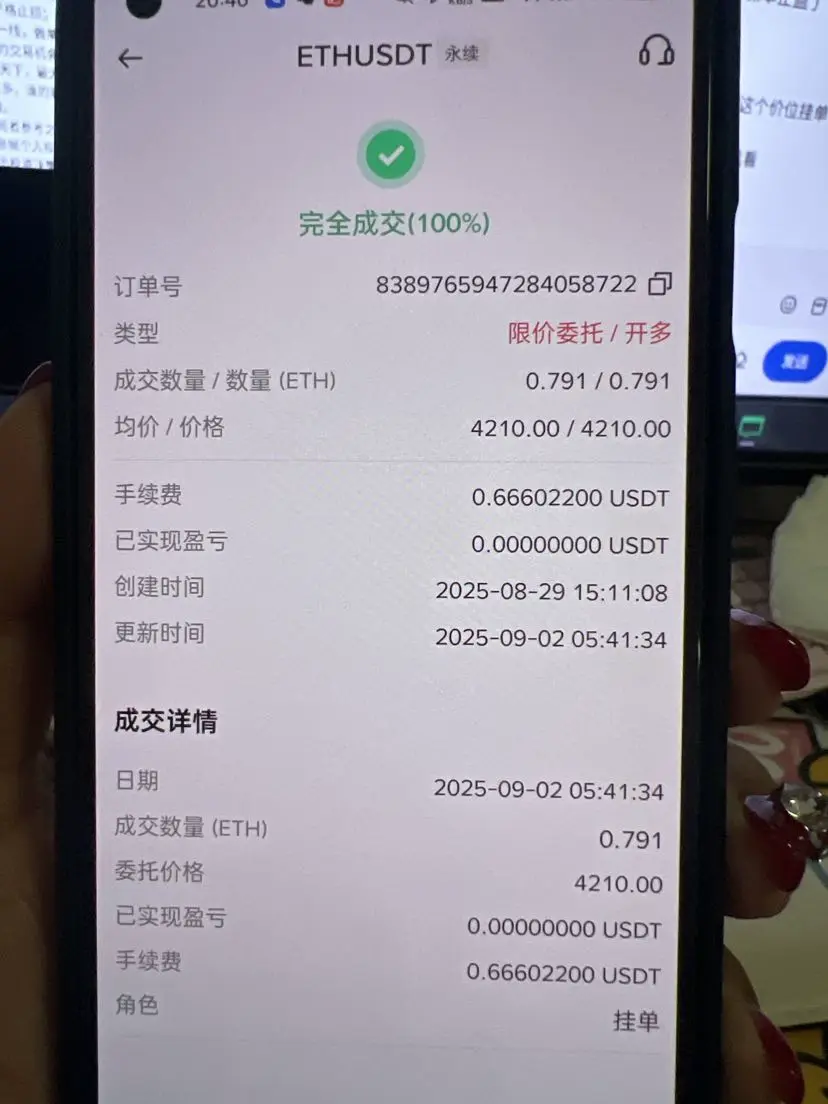

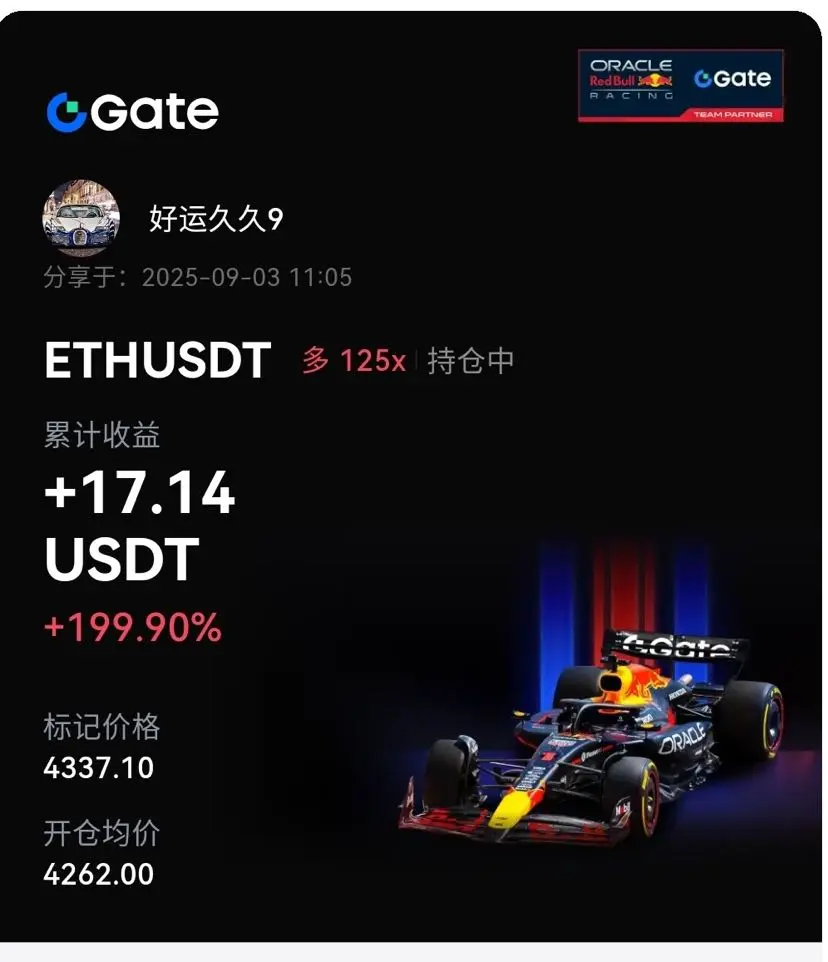

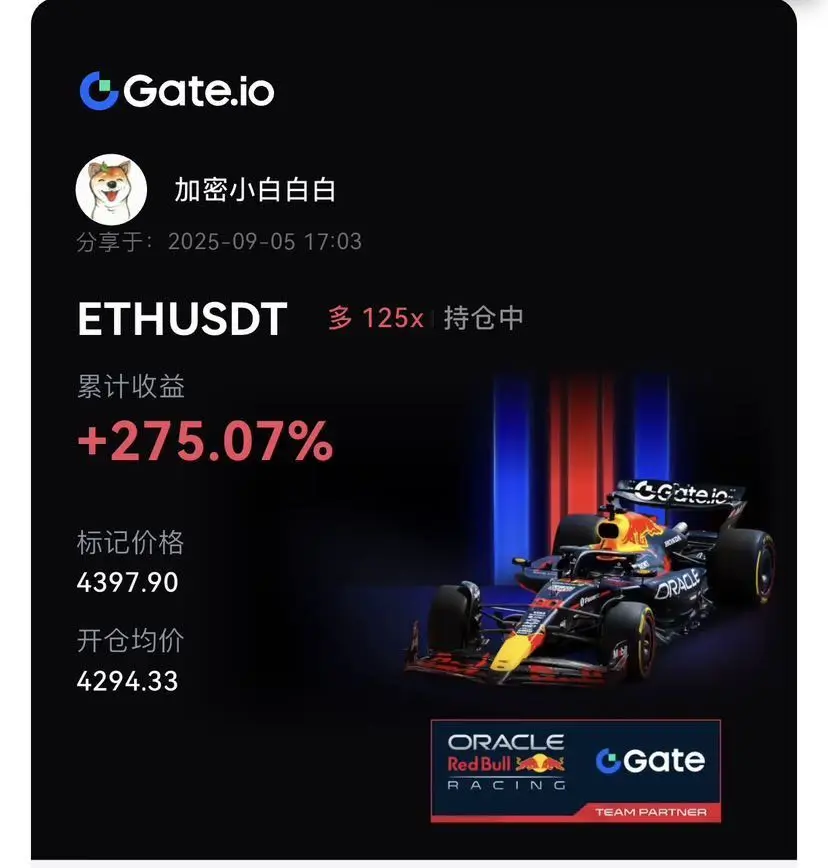

1.以ETH/USDT永续为例,当前主方向为多,考虑到价格结构未发生明显变化,仍维持前期观点不变,4831以下,多方震荡上行,继续洗盘,其重要支撑位4206,以上,多方继续蓄力,稳健型投资者需增加持仓信心和时间;

2.若再次回落至4206附近可依据《机构强拐点模型》(此模型详细讲解可关注《K线数字密码》后回看直播视频)轻仓试多,严格止损;破4206,上涨结束,回落开始,调整做单思路策略。

3.短期空方压力位4526,过此位继续看高一线至4831,做单思路仍以逢低多为主,高空为辅或者不作空,舍弃一些平庸的交易机会。

未来中国是一群正知、正念、正能量人的天下,最大的危

1.以BTC/USDT永续为例,当前主方向为空,考虑到价格结构未发生明显变化,仍维持前期观点不变,日线级别震荡下行,空方制约上限为128830;

2.近期空方压力位112585-113620,以下,高空为主,未进场者耐心等待反弹中1小时周期《机构强拐点模型》(此模型详细讲解可关注《K线数字密码》后回看直播视频)中空单交易机会。

3.110421以上,短期继续反弹,低多为辅,压力位附近不建议盲目追多;如站上112585则看高一线至113620,短期需调整做单思路和策略。108333以下,继续看跌,或产生新的价格结构,则多方反弹会随之而来,对ETH有牵引力。

二、ETH机构价格结构分析与策略

1.以ETH/USDT永续为例,当前主方向为多,考虑到价格结构未发生明显变化,仍维持前期观点不变,4831以下,多方震荡上行,继续洗盘,其重要支撑位4206,以上,多方继续蓄力,稳健型投资者需增加持仓信心和时间;

2.若再次回落至4206附近可依据《机构强拐点模型》(此模型详细讲解可关注《K线数字密码》后回看直播视频)轻仓试多,严格止损;破4206,上涨结束,回落开始,调整做单思路策略。

3.短期空方压力位4526,过此位继续看高一线至4831,做单思路仍以逢低多为主,高空为辅或者不作空,舍弃一些平庸的交易机会。

未来中国是一群正知、正念、正能量人的天下,最大的危