When the First Stablecoin Stock Meets a High-Performance Layer 1 — Why Sei Stands Out

On July 10, Circle officially announced the integration of native USDC and CCTP V2 on Sei, following its rollout on major ecosystems like Ethereum, Solana, Base, and Arbitrum. This move not only designates Sei as a leading network in the USDC integration landscape but also underscores its ecosystem strength and growth potential.

So, what is CCTP V2? In brief, it’s Circle’s next-generation Cross-Chain Transfer Protocol, purpose-built for seamless, one-stop cross-chain transfers. With CCTP V2, users and developers can securely move native USDC across 13 leading public blockchains and 156 routing paths—no complicated bridging, no liquidity fragmentation, no excessive fees. It’s as intuitive and frictionless as moving cash between cities.

The significance of this integration goes well beyond simply “adding another chain.” Native USDC support has become a major benchmark for a blockchain’s ecosystem activity and real user traction. As the largest regulated USD stablecoin globally, every new Circle USDC integration reflects deep confidence in a chain’s user base, capital scale, and developer ecosystem. By joining the select group of “natively supported USDC” networks, Sei officially enters the “mainstream blockchain club.” This sets the stage for an influx of capital, users, and developers, and heralds the next surge of ecosystem growth.

The Stablecoin Bull Market Is Here

To understand the impact of native USDC and CCTP V2, the industry’s macro trends fueling this “stablecoin bull market” should be considered.

Start with capital markets: Since last year, news of Circle’s IPO filing has kept the industry’s attention, and its post-IPO performance has stunned many.

On June 5, 2025, Circle made its debut on the New York Stock Exchange (CRCL), pricing at $31 a share. Shares closed the first day at $83.23—up 168.5%—and the market cap quickly shot past $18 billion, making it one of the strongest IPOs in the last four years. The rally didn’t stop there: by mid-June, Circle’s stock had gained over 500%. As of early July, the price briefly approached $300, with market cap reaching about $56 billion.

Regulatory momentum followed quickly. The U.S. Stablecoin Act brought the sector reassurance: for the first time, the White House, Congress, and federal regulators reached consensus, officially granting stablecoins money status and requiring full reserves, compliance reviews, and redeemability—setting “high standards” for the industry. Stablecoins are no longer experimental “gray area” products, but fully protected under U.S. law and officially sanctioned as monetary tools. For developers, institutions, and capital providers, this regulatory breakthrough marks the true arrival of the compliant era.

With the Stablecoin Act (GENIUS Act) now law, the biggest Wall Street banks have jumped in. JPMorgan, Citi, Bank of America, and Morgan Stanley all announced, on their Q2 earnings calls, plans to enter the stablecoin space.

Over the last year, stablecoin growth has outpaced nearly all native assets on major blockchains. Measured by volume, settlements, and cross-border flows, USDT and USDC are firmly established as the “on-chain dollar.” In fact, stablecoins today arguably come closest to realizing Satoshi Nakamoto’s vision for peer-to-peer electronic cash.

Having a mainstream native stablecoin is now a real-time barometer for a blockchain’s ecosystem health. Stablecoin issuance and growth signals true user demand and fresh capital, while stablecoin burns or exits signal weakening activity.

From this perspective, the native USDC and CCTP V2 integration affirms Sei’s track record of steady growth.

Sei’s Consistent Growth

As a rising blockchain, Sei has posted standout on-chain activity numbers over the last six months. Since the start of 2025, TVL has soared from $208 million to $600 million—an impressive 188% year-to-date increase. More than 200 Dapps are now live, the developer community is thriving, and innovation is constant. The mainnet, already featuring lightning-fast EVM compatibility, is on the verge of a “Giga Upgrade” that will dramatically boost scalability. Daily on-chain transactions, active users, and token prices are all hitting record highs.

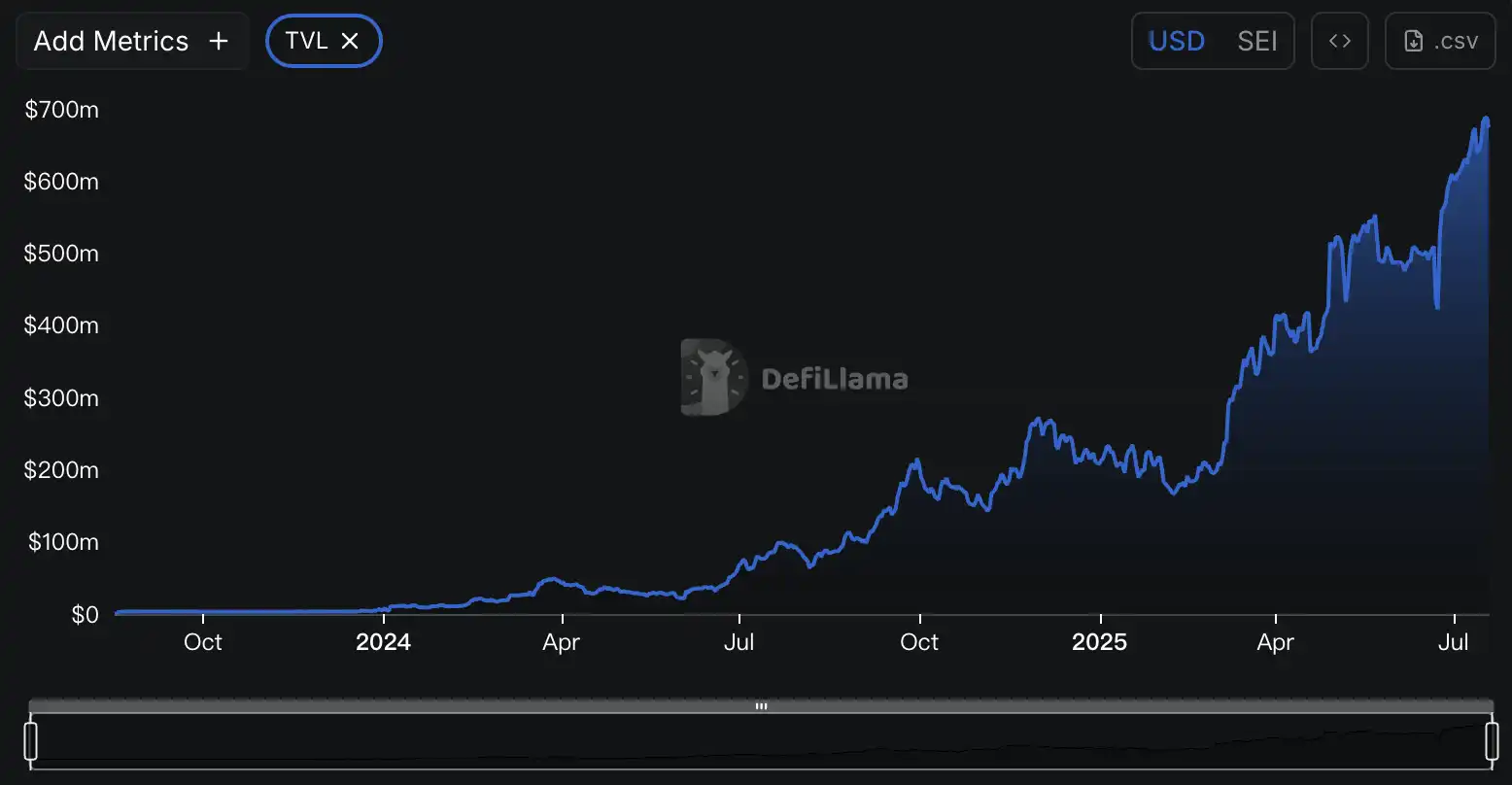

Sei’s blazing ecosystem growth over the last 18 months is visible in every key metric.

First, TVL (Total Value Locked): from less than $10 million in October 2023, past $100 million by mid-2024, and breaking $700 million by July 2025, Sei’s TVL has grown nearly exponentially. In late 2024, as top DeFi projects launched on Sei, TVL jumped above $250 million. With even more cross-chain bridges, liquidity mining, and innovative protocols going live in 2025, TVL surged again—more than 230% above its start-of-year mark, reflecting robust new inflows.

Data Source: DefiLlama

TVL growth has been powered in part by Takara Lend and Yei Finance. Takara Lend now holds over $100 million in TVL, with annual USDT yields at 15.64% and USDC at 14.79%. It is evolving from a lending protocol into a programmable credit layer within DeFi protocols—enabling crypto not just for investment, but real-world payments. Yei Finance, Sei’s top lending project, has $380 million TVL and leads the ecosystem.

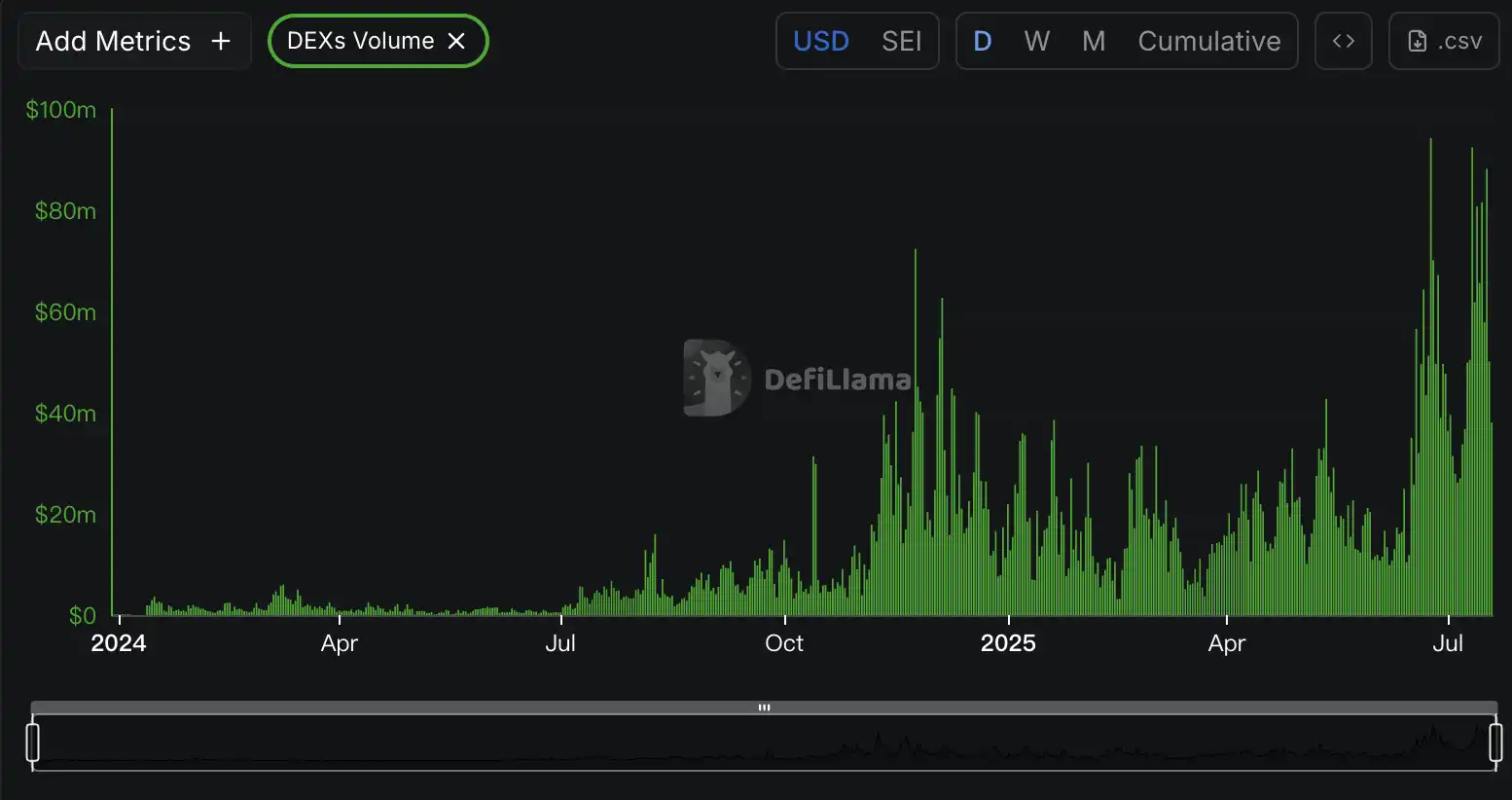

Average daily DEX volume tells a similar story. Until July 2024, daily decentralized exchange volume on Sei rarely topped $10 million. But after September 2024, new projects and users flooded in, and daily volumes quickly crossed $100 million. Since 2025, as USDC, CCTP, and other regulated funding mechanisms opened up, and as the AMM ecosystem diversified (with concentrated liquidity, limit orders, cross-chain trading, and more), Sei daily DEX volume has regularly set new highs—$80 to $100 million—signaling both a vibrant market and strong user engagement.

Data Source: DefiLlama

Market cap trends round out the picture: Sei’s token rebounded from under $300 million in late 2023, spiked to $1.8 billion with the first airdrop and mainnet launch in early 2024, and has held above $1 billion ever since. In March 2025, more institutional investors and compliant tools entered the market, driving market cap to a $2.8 billion high. Lately, the token price has held firm in the $2–2.5 billion zone. With synchronized gains in TVL, trading volume, and market cap, Sei demonstrates its ability to attract liquidity across retail and institutional segments, fulfilling its high-performance Layer-1 objectives.

Data Source: DefiLlama

Meanwhile, Sei has been tapped by the Wyoming Stable Token Commission as a candidate chain for WYST, a USD stablecoin backed by fiat. WYST plans to use LayerZero for cross-chain bridging—an indicator that more sovereign or institution-backed stablecoins may choose Sei for their launches.

On the RWA (Real World Asset) front, Sei just landed another major project. On July 17, 2025, Ondo Finance announced that its flagship U.S. dollar yield token USDY (United States Dollar Yield) is live on Sei—making it the first tokenized Treasury asset on this ultra-fast Layer‑1. USDY runs on multiple chains, boasts $680 million in TVL, and offers an annual yield around 4.25% for global (excluding U.S.) investors. This integration fuses high-grade Treasury yields with Sei’s ultra-high throughput—and marks Sei’s first direct challenge to the institutional DeFi market.

Sei’s development initiatives extend further. The “Giga Upgrade” is at the center of a foundational infrastructure overhaul. The new Giga whitepaper details: a homegrown, high-throughput EVM client capable of gigagas throughput (billions of gas per second) via pre-compilation, static dependency analysis, and parallel execution; Autobahn multi-lane consensus that breaks single-proposer bottlenecks with multi-proposer parallel packaging, shrinking confirmation times below 700 milliseconds; asynchronous state commits and efficient storage paths that leverage async state root generation, write-ahead logging, and batch writes to decouple contract execution from state updates and slash latency.

In internal tests, Sei deployed a 40-validator network spanning Singapore, Germany, Ohio, and Oregon, simulating real-world latency and bandwidth. Under these conditions, Sei Giga delivered 5 Gigagas/s throughput and sub-second confirmations—delivering true Web2-grade on-chain performance.

These advances—from financial protocols to infrastructure—are multiplying Sei’s ecosystem use cases and enhancing its credit, compliance, and cross-chain asset capabilities. From TVL and trading volume to lending yields, rollout of compliant stablecoins, and high-performance upgrades, Sei is operating at peak performance, demonstrating relentless Layer-1 momentum.

USDC & CCTP V2 Integration: A Game Changer for Sei

The native integration of USDC and CCTP V2 is more than a technical upgrade for Sei—it’s a leap forward in ecosystem value. Every key factor—user experience, capital flows, developer activity, and market reputation—gets a major boost.

For end users, native USDC delivers confidence and unmatched efficiency. As the world’s top compliant stablecoin—with 100% backing, 1:1 USD redeemability, and top-tier regulatory oversight—USDC enables seamless capital flows for both retail and institutional users. Institutions can move large sums in and out, and settle via Circle Mint with full compliance and liquidity. By adding native USDC, Sei offers users direct access to Circle’s global payment rails. Whether you’re a DeFi trader, project team, or large-scale fund manager, switching between on-chain and off-chain dollars is now effortless.

The true breakthrough comes from CCTP V2’s multi-chain reach. CCTP V2 allows Sei to natively send and receive USDC with Ethereum, Solana, Arbitrum, Base, Optimism, and 13 major chains, covering 156 capital routing paths. For users, cross-chain transfers become instant and frictionless—no more complex bridges, repetitive swaps, or liquidity worries.

Developers can leverage CCTP V2 to build seamless cross-chain DEXs, wallets, liquidity pools, GameFi, payments, RWA, and on-chain financial products on Sei. This gives users smooth USDC payments and transfers across any chain.

Sei itself becomes a multichain strategic hub, attracting liquidity, users, and builders from Ethereum, Solana, and beyond—not just its own ecosystem.

The transition from Noble-based USDC to native USDC marks a new phase. With native USDC here, Circle and the Sei Foundation are coordinating an orderly shift of liquidity from Noble-based USDC to Sei-native USDC. This provides greater asset security, transparency, compliance, and global DeFi/CeFi connectivity.

What’s more, Circle’s “native ecosystem” pull will draw international capital, top-tier compliant users, and institutional players to choose Sei as their on-chain hub. Each liquidity upgrade enhances Sei’s ecosystem reputation, scale, and brand strength.

Looking ahead, Circle’s arrival also upgrades Sei’s global influence and brand premium. Beyond liquidity, this opens doors for Circle’s partners, Dapps, compliant institutions, and even traditional financial giants to establish a presence on Sei—enabling on-chain USD lending, RWA, treasury issuance, and cross-border settlement. Historical trends indicate that benchmark chains integrating native USDC have experienced significant ecosystem and capital growth shortly thereafter.

For those considering Sei’s future, this represents more than a technical advancement; it is a gateway to a new period of market growth. On-chain capital, users, and innovation will propel Sei to a new stage with USDC as the “connective tissue.”

The acceleration of Sei’s TVL, the expansion of stablecoin market cap and liquidity, and the emergence of new innovations and multichain scenarios will directly influence whether Sei becomes the next prominent public blockchain.

Disclaimer:

- This article is republished from [BLOCKBEATS]. Copyright belongs to the original author [BLOCKBEATS]. If you have any concerns about this republication, please contact the Gate Learn Team, who will handle your request promptly and in accordance with relevant procedures.

- Disclaimer: The opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article have been translated by the Gate Learn Team. No reproduction, distribution, or plagiarism of translated articles is allowed unless Gate is expressly cited.