3.5 billion is just the starting point: What are the hidden wealth secrets within Arbitrum’s RWA ecosystem?

Summary

For many, access to real-world assets (RWAs) has become a key indicator of whether crypto is truly going mainstream: only by connecting blockchain with traditional finance can cryptocurrency establish itself as a compelling mainstream asset class.

That vision is becoming reality—U.S. Treasuries, bonds, and even real estate have already been tokenized and brought on-chain.

Thanks to both clearer regulation and advancing technology, RWAs are gaining strong momentum.

This report centers on the Arbitrum ecosystem, a Layer 2 network that has successfully launched several RWA-focused projects—currently with over $350 million in RWA total value locked (TVL).

We’ll provide an overview of RWAs on Arbitrum, examine the drivers and initiatives behind their growth, highlight major asset categories and providers (with case studies), and discuss risk factors and future prospects.

RWAs on Arbitrum: An Overview

The RWA market is booming. Early crypto adopters once imagined the day when Wall Street professionals would use digital assets. Today, that’s happening—real-world assets have made it on-chain and are seeing widespread use.

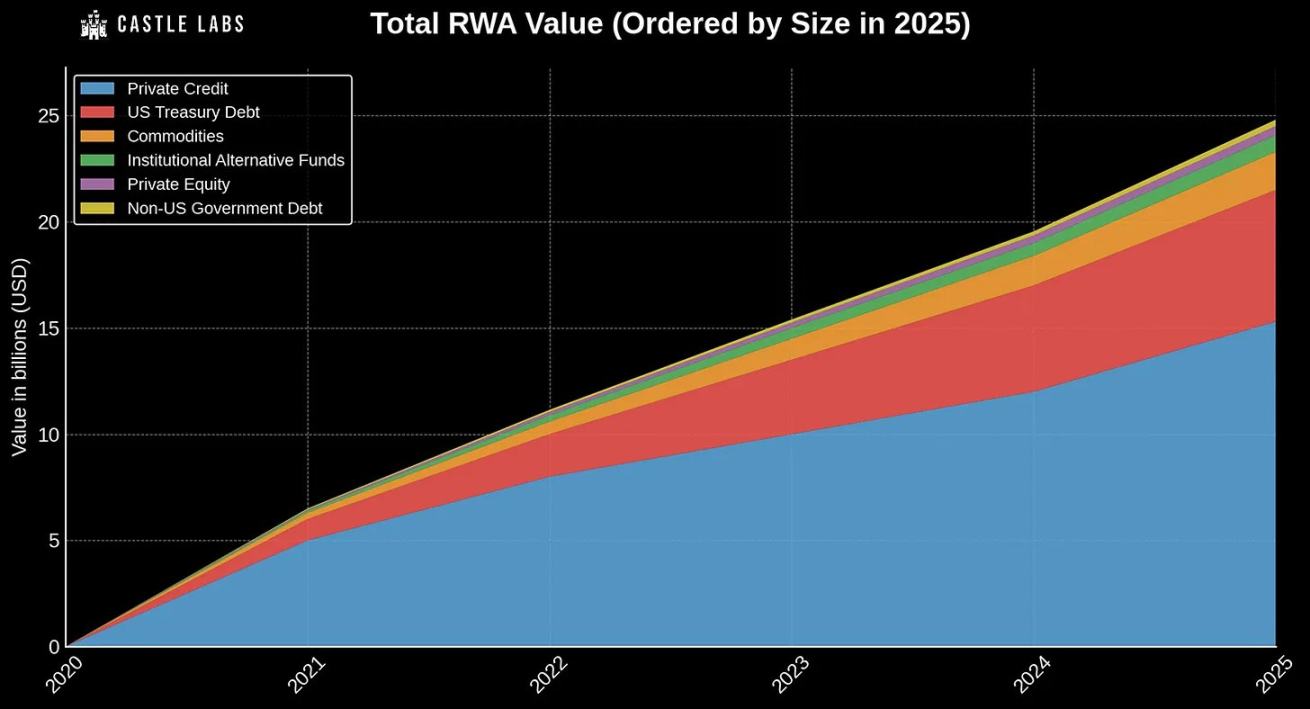

Source: rwa.xyz

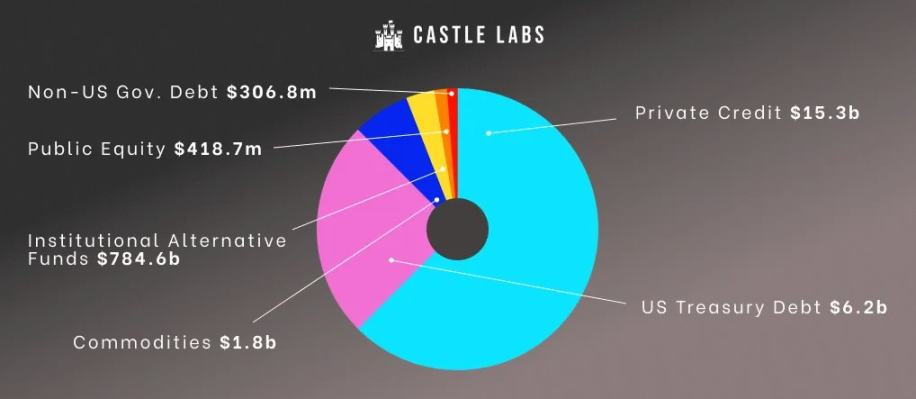

The total value of RWAs now exceeds $25 billion, distributed as follows:

Source: rwa.xyz

- Private credit: $15.3 billion (60%)

- U.S. Treasuries: $6.2 billion (26.9%)

- Commodities: $1.8 billion (7.2%)

- Institutional alternative funds: $784 million (3.26%)

- Private equity: $418.7 million (1.71%)

- Non-U.S. government bonds: $306 million (~1.2%)

Bringing RWAs on-chain has been enabled by several converging factors:

- More mature regulatory frameworks for digital assets

- Technical infrastructure that’s now truly production-ready

- Rapidly growing institutional interest

Crypto is increasingly accepted and regulated—think the EU’s MiCA and the new U.S. GENIUS Act—making these assets more legitimate across the global financial landscape.

Meanwhile, blockchains like Bitcoin and Ethereum have delivered over a decade of secure, active, decentralized operations.

Yet RWAs, by their very nature, demand greater safeguards before being brought on-chain. Layer 2 solutions—like Arbitrum—are particularly attractive to institutions, reducing on-chain costs by several orders of magnitude compared to Ethereum mainnet.

Among all Layer 2s, Arbitrum stands out as one of the fastest-growing solutions for RWAs.

Why Arbitrum?

- Mature, robust technology stack

- Credible neutrality in blockspace

- One of the industry's largest liquidity pools

Arbitrum's tech stack emphasizes engineering-driven growth. Innovations like Stylus and Timeboost make it a formidable alternative to Ethereum mainnet.

Its backend tech has also powered cross-chain USDC bridges for projects like Hyperliquidx—demonstrating capabilities beyond its native ecosystem and underscoring its credible neutrality. “Credible neutrality” means the chain treats all users, apps, and outcomes evenhandedly, upholding fairness and impartiality.

Why credible neutrality matters:

- Trust: Users and institutions prefer platforms that don’t arbitrarily change rules or favor specific parties.

- Security: Neutral systems are less vulnerable to manipulation or centralization.

- Composability: DeFi innovation thrives when developers know there’s no protocol favoritism.

- Institutional confidence: For RWAs, neutrality ensures tokenized assets won’t face bias or hidden risks (like censorship or prejudiced governance).

Arbitrum also boasts the sixth-largest liquidity pool in the sector, with over $1.17 billion in assets, and hosts one of the industry’s most sophisticated stablecoin ecosystems.

RWAs represent tangible and yield-bearing assets, enhanced by blockchain’s programmability and transparency. This offers institutional investors and DAOs new ways to diversify, earn stable yields, and optimize capital efficiency.

Key Initiatives Behind the Growth

This section reviews RWA development milestones within Arbitrum. The ecosystem’s early progress was driven jointly by the Arbitrum Foundation and its DAO.

The DAO’s first move in RWAs was the Stable Treasury Endowment Proposal (STEP), followed by the RWA Innovation Grant (RWAIG), a treasury management proposal, and then STEP 2.

STEP (April 2024)

STEP planned to deploy over $85 million (35 million ARB) into tokenized U.S. Treasuries and other real-world assets via institutional issuers.

Though initially just a pilot, after careful vetting, several providers were selected:

- Securitize BUIDL

- Ondo Finance USDY

- Superstate USTB

- Mountain Protocol USDM

- OpenEden TBill

- Backed bIB01

Selection criteria included:

- No investment restrictions

- Clear organizational structure with no siloed departments

- Substantial AUM, multiple ISIN exposures, strong team experience

- Use of public or decentralized tools (not solely proprietary networks)

- No extra decentralized governance layers for applicants

- Detailed and thorough documentation

To ensure broad coverage, STEP also plans to invest 1% of the DAO treasury into tokenized RWAs each year for the next five years. The program also gave practical experience in RWA analysis and balancing growth with principal protection. Future versions may focus more on either goal.

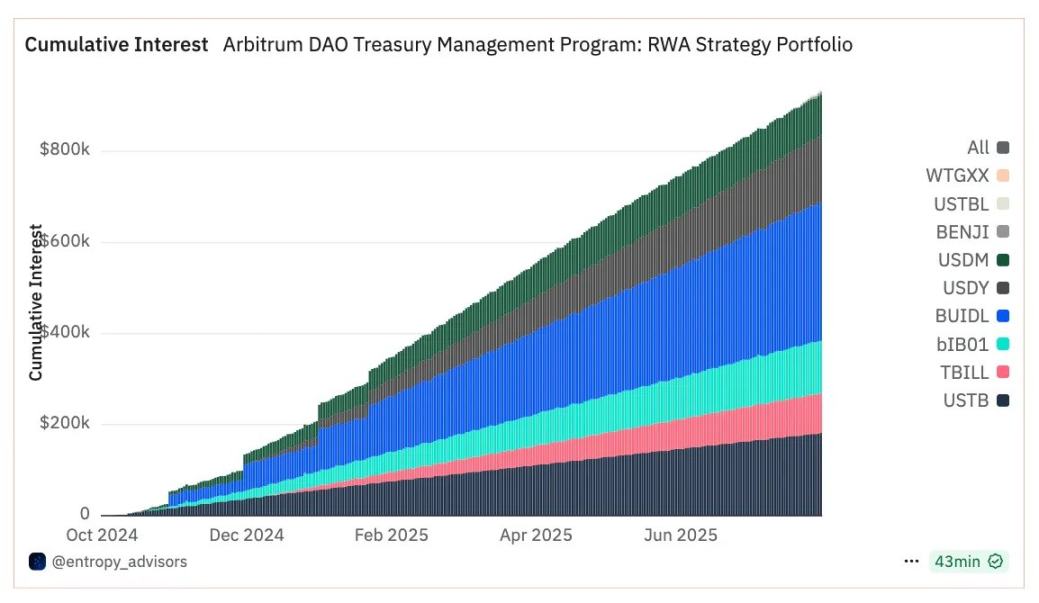

STEP has been a major success—generating $600,000 in interest for the DAO in under a year.

Monthly cumulative totals:

STEP is unique for its institutional partnerships, built on principles of:

- Direct selection and management of yield assets—no intermediaries

- Request-for-Proposal (RFP) model: protocols submit and undergo evaluation

- Institutions apply directly via decentralized forums, generating sustainable DAO revenue

RWAIG Innovation Grants (June 2024)

The Arbitrum Foundation funded RWAIG, a two-month pilot (June–August 2024) with a budget of 300,000 ARB, designed to support RWA integration, analytics, and research in Arbitrum.

The main goals:

- Boost RWA activity and secure Arbitrum’s leadership as a growth platform

- Explore how the DAO treasury can deploy funds into RWAs and facilitate on-chain tokenization

- Broaden RWA and tool integration within major apps like GMX, Aave, and Pendle

The grant supported eight projects:

- RWA research: user education

- PYOR: RWA analytics dashboard

- Mystic Finance: RWA-collateralized lending

- Jia: tokenizing SME receivables

- Truflation: real-time inflation data

- Backed Finance: structured products tracking securities

- Infinfty: ERC-6651 RWA tokens for product lifecycle, performance, ownership, and ESG tracking

Treasury Management (December 2024)

A new treasury management proposal appeared at the end of 2024, complementing STEP’s early-phase work. It aims to shift from idle ARB holdings to yield-generating on-chain strategies.

Main objectives:

- Asset management: deploy 25 million ARB for on-chain yield

- Stablecoin swaps: streamline ARB-to-stablecoin conversions, minimizing slippage and market impact

- Stablecoin liquidity: convert 15 million ARB to stablecoins and deploy into low-risk yield strategies for DAO expenses and provider payments

- Diversification and stability: prioritize risk-adjusted returns and principal protection

The strategy has two tracks:

- Treasury: 10 million ARB for pure ARB strategies; 15 million ARB converted to stablecoins for DAO operations

- Growth: 7,500 ETH allocated to DeFi protocols

STEP 2 (January 2025)

Encouraged by early STEP success, STEP 2 was approved—with another 35 million ARB (about $15.7 million) allocated.

After reviewing 50+ applications, STEP allocated funds as follows:

- WisdomTree WTGXX: 30%

- Spiko USTBL: 35%

- Franklin Templeton FOBXX (BENJI): 35%

The DAO clearly endorsed the importance of this program.

STEP 2 passed by a wide margin: nearly 89% in favor, 11% abstaining, and just 0.01% opposed.

Combined, these initiatives have fueled Arbitrum’s RWA TVL from nearly zero to over $70 million in under a year.

So what’s the current outlook?

What does Arbitrum’s RWA landscape look like now?

Next, we’ll use on-chain data to examine Arbitrum’s RWA assets, providers, and growth trajectory.

RWA Growth on Arbitrum

Combining low costs, high throughput, and credible neutrality, Arbitrum is quickly building an ecosystem of issuers, infrastructure partners, and incentive programs to accelerate RWA adoption on-chain.

While Arbitrum originally focused on DeFi primitives, DEXs, lending, and yield aggregators, the idea of on-chain RWAs gained traction after early tokenized Treasury pilots on Ethereum in 2022.

Today, Arbitrum RWAs have a market cap close to $350 million, with over 129 tokenized asset types. That’s just 1.39% of the total RWA market cap—suggesting huge growth potential ahead.

Although forecasts vary, several predict explosive RWA expansion:

- $16 trillion by 2030 (10% of global GDP)

- $30 trillion by 2034

In the first scenario, that would mean 40x growth over five years.

As one of the most advanced on-chain RWA networks, Arbitrum could gain a decisive competitive edge.

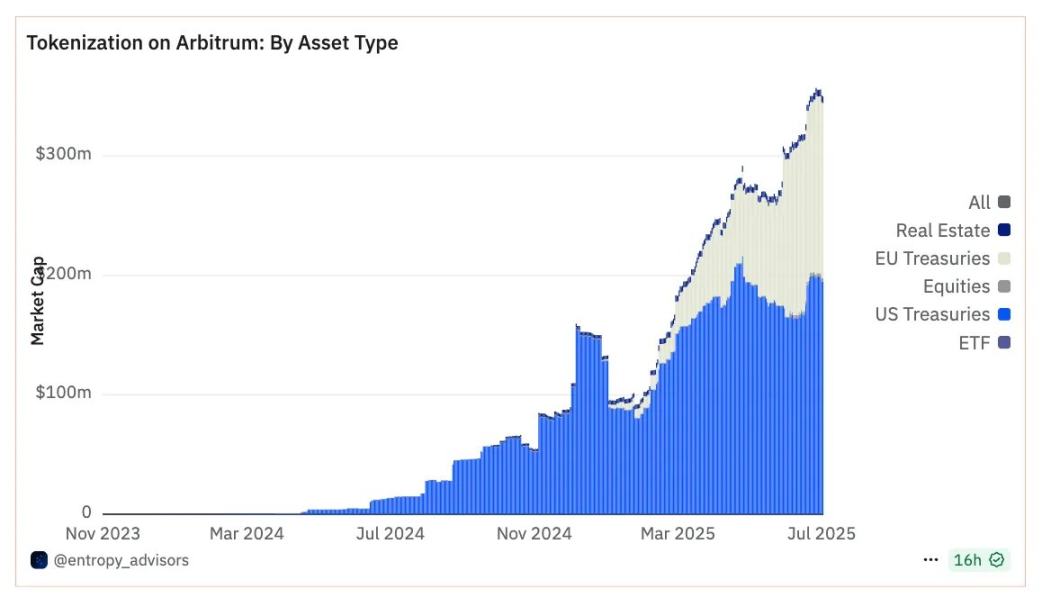

RWA Growth Trajectory on Arbitrum

In 2024 alone, Arbitrum’s RWA TVL jumped from nearly zero to almost $85 million by year-end.

This growth unfolded in three stages, each closely linked to the major initiatives above:

- Early growth (Q1 2024): TVL jumped from almost zero to $5 million, signaling early momentum.

- Accelerated growth (Q2 2024): TVL grew from $20 million to about $70 million—matching the STEP 1 funding timeline.

- Continued expansion: As new DAO allocations (STEP 2) and issuers (Spiko, WisdomTree, BlackRock) entered, the stage is set for sustained growth in 2025.

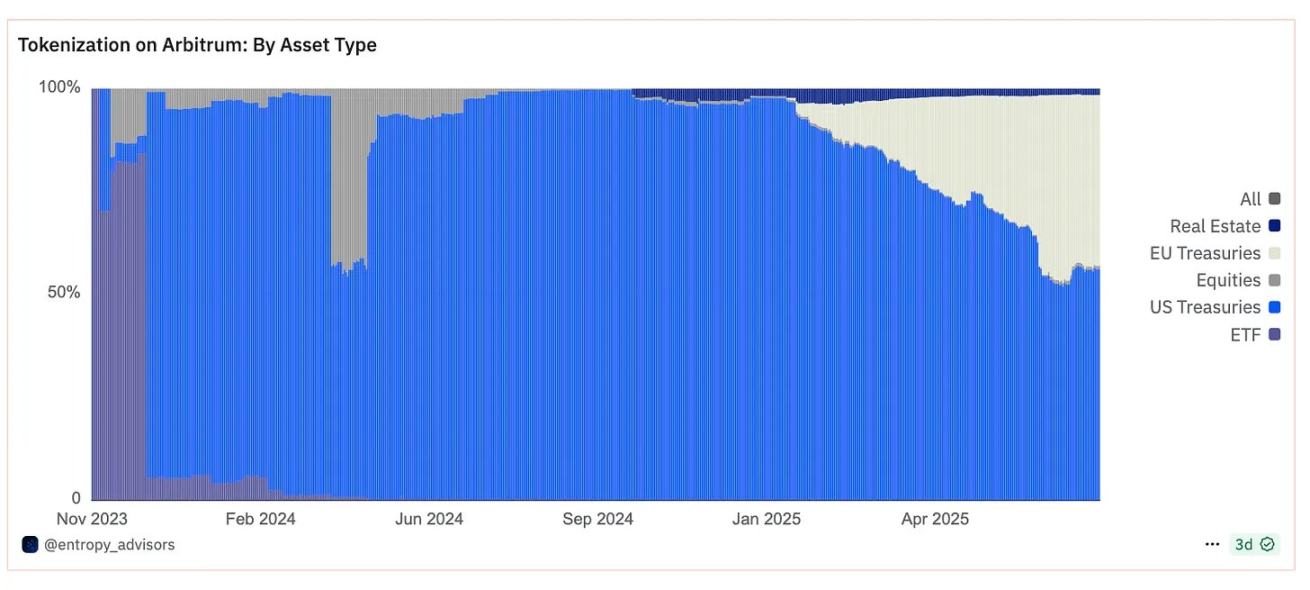

This evolution is reflected in the supported asset types. In 2024, most RWAs were U.S. Treasuries; over time, more asset classes have emerged.

U.S. Treasuries are still dominant ($197 million), but EU sovereign bonds are catching up ($150 million). Real estate, equities, and ETFs are also gaining traction.

RWA Assets and Providers

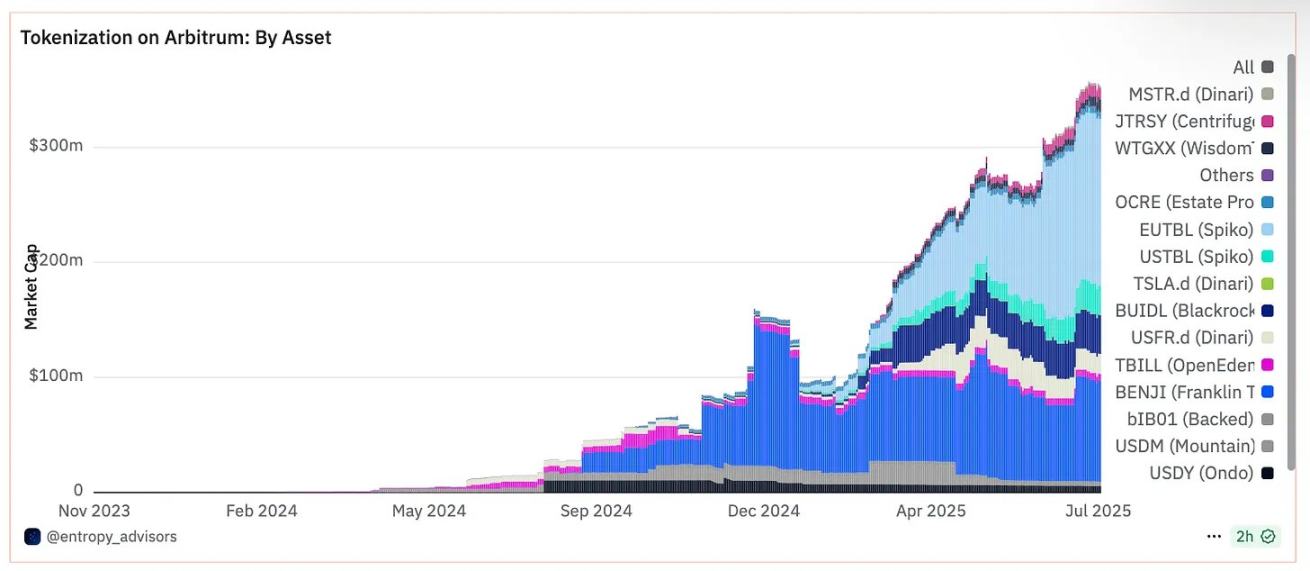

This section explores RWA asset categories, spotlighting the top 10 products by TVL and profiling key issuers.

Spiko

Spiko operates an on-chain platform for issuing and distributing tokenized securities.

Licensed by France’s AMF, Spiko has launched two money market funds:

- Spiko Euro (EUTBL)

- Spiko Dollar (USTBL)

Both funds are backed by short-term sovereign debt, offering yields close to risk-free central bank rates. EUTBL tops the leaderboard with $146 million in TVL; USTBL ranks fourth with $24.8 million—proving once again that short-dated sovereign debt is the primary on-chain RWA use case.

Franklin Templeton

Franklin Templeton, listed on the NYSE (BEN), is a leading global asset manager.

To bring tokenized mutual funds on-chain, it launched the BENJI mobile app with a proprietary ledger system for securities and crypto.

Each BENJI token corresponds to one share in Franklin’s on-chain US Government Money Market Fund (FOBXX). BENJI is currently Arbitrum’s second-largest RWA, valued at over $87 million.

Securitize

Securitize gives institutions access to tokenized securities.

On Arbitrum, it provides BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL).

This is a tokenized short-term Treasury product focused on delivering on-chain dollar yields, with over $33 million in TVL.

Dinari

Dinari enables on-chain tokenization of equities, ETFs, and indices—called “dShares”—all fully backed 1:1 by the underlying assets.

Its Arbitrum products include:

- WisdomTree Floating Rate Treasury Fund (USFR.d): $15 million+ TVL

- Tokenized MicroStrategy shares (MSTR.d): $1.8 million

- Tokenized Tesla shares (TSLA.d): $450,000

- Tokenized S&P 500 Index ETF Trust (SPY.d): $141,000

These highlight the potential for stocks and indices, even though their current share on Arbitrum is still small.

OpenEden

OpenEden enables access to tokenized U.S. securities. Licensed by Bermuda’s regulator, it also holds a digital asset business license and a Moody’s “investment grade” rating.

It is a leading issuer of tokenized Treasuries in Europe and Asia, and its TBILL pool lets users invest directly in short-term U.S. government debt.

Currently, TBILL deposits exceed $5.8 million.

Ondo

Ondo gives investors exposure to institutional-grade financial products.

On Arbitrum, its USDY product has gained traction, with TVL now at $5.7 million.

USDY is a yield-bearing stablecoin backed by U.S. Treasuries, currently yielding 4.29% per year.

Arbitrum’s RWA ecosystem is robust and diversified, yet still in early stages.

Growth will depend on:

- Expanding asset coverage to meet wider demand

- Maintaining RWAs as a strategic Arbitrum focus

- Cooperation among Arbitrum Alliance Entities (AAEs)

- Institutional business development

Future Outlook

The STEP 1 providers were joined by new entrants in STEP 2, further diversifying Arbitrum’s RWA assets and products.

Given the current pace, projections for Arbitrum's RWA TVL include:

- Reaching a billion-dollar RWA ecosystem

- Adding more asset types (private credit, real estate, yield stablecoins, etc.)

- Achieving deeper cross-chain and network interoperability

Despite meaningful progress, Arbitrum has considerable headroom for growth if it wants to lead. It currently ranks seventh in RWA network TVL—its $350 million TVL amounts to just 1.39% of the total on-chain RWA market cap.

For Arbitrum to catch up, it must explore private credit, corporate bonds, precious metals (like gold and silver), and equities.

Entropy, which is deeply involved in Arbitrum’s treasury management and RWA work, shared Matt’s perspective on the network’s RWA future:

“Right now, most RWA issuers are focused on reducing the operational costs of issuance and settlement. Achieving this at scale will take time. The next big leap for Arbitrum RWAs will be unlocking composability—not just adding new asset classes or issuers, but ensuring these assets can integrate with advanced on-chain primitives built over the last decade: exchanges, lending protocols, index products, liquidity optimizers, and whatever comes next. The goal is open, permissionless transferability, so RWAs are as composable as native crypto. We’re not there yet (given today’s regulatory realities, this is ambitious), but that’s the target. The fact that major players like Franklin and WisdomTree are now issuing tokens themselves is promising institutional engagement, and I expect to see that trend continue. If we achieve real RWA user activity on-chain—trading, lending—even through permissioned Arbitrum channels—it could open up a whole new world.”

We agree wholeheartedly with Matt, especially regarding composability and accessibility. On-chain use cases are just beginning for these assets. We look forward to seeing Treasury bills, bonds, stocks, and commodities not only tokenized, but also integrated into DeFi primitives in the near future.

Methodology note: Stablecoins are excluded from the scope of this RWA-focused analysis, as our purpose is to spotlight asset types currently available on Arbitrum.

Finally, some key RWA-related risks and considerations must be kept in mind.

Risks and Forward-Looking Considerations

- Ecosystem-token disconnect: RWA ecosystem growth doesn’t automatically translate to ARB token appreciation.

- Asset concentration risk: Short-term Treasuries still dominate, highlighting the need to diversify into private credit, corporate bonds, real estate, and other asset classes.

- Regulatory uncertainty: Although crypto regulation is improving, compliance frameworks for tokenized securities are still developing and institutional issuers require clear, coordinated oversight across jurisdictions.

Expansion into private credit, real estate, and other RWA categories could push Arbitrum's RWA TVL close to $1 billion by year-end.

With treasury management and STEP 2 moving forward, continued reporting will offer fresh insights for future decisions and ecosystem development.

Conclusion

In just over one year, Arbitrum’s RWA TVL has climbed from virtually zero to $350 million.

The STEP program and DAO-led initiatives have been pivotal for early growth, introducing a diverse suite of institutional-grade products such as short-term Treasuries, money market funds, and tokenized equities to Arbitrum.

The arrival of major players like Franklin Templeton and WisdomTree further solidifies Arbitrum’s position as a secure, neutral, low-cost institutional DeFi network.

But this is just the beginning.

Looking ahead, Arbitrum faces strategic opportunities—including expanding into underrepresented RWA categories like private credit, real estate, and commodities, but above all—enhancing composability so these products can integrate deeply with Arbitrum’s DeFi core (DEXs, lending markets, and liquidity pools).

As initiatives like STEP 2 and new treasury strategies inject practical experience and momentum, collaboration among the DAO, alliance entities, and institutional players will be crucial for long-term leadership in RWAs.

Disclaimer:

- This article is republished from [Foresight News]. Copyright belongs to the original author [Castle Labs]. For concerns regarding republication, please contact the Gate Learn team, and we will address them promptly as per our procedures.

- Disclaimer: The views and opinions expressed here are those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team and may not be reproduced, distributed, or copied referencing Gate without explicit credit.

Related Articles

Exploration of the Layer2 Solution: zkLink

A Comprehensive Guide to LayerEdge

What is Plume Network

Battle of Public Chains: Analyzing the On-Chain Data and Investment Logic of ETH, SOL, SUI, APT, BNB, and TON

What is Conduit