Silver ETF Investment Beginner’s Guide: SIVR Investment Opportunities

The co-founder of DWF described Falcon Finance as “a protocol that lets you enter with any asset, earn yield, and exit anywhere with any asset.”

This vision is ambitious and goes far beyond what most stablecoin projects aim for. It’s what makes USDf stand out—today’s market is flooded with stablecoins, many almost indistinguishable from one another, but in the end, it’s the projects that break the mold that win.

Standing out doesn’t necessarily mean being “right.” Where does Falcon’s uniqueness lie, and can it be a winner?

Unique Origins

USDf (Falcon Finance) comes from a very different background.

Falcon Finance was founded by the team from DWF Labs, with Andrei Grachev serving as both co-founder of DWF Labs and managing partner at Falcon.

DWF Labs and DWF Ventures are veteran market makers and investment firms in the crypto industry, with extensive experience in market making for major altcoins and high-profile meme coins—boasting impressive results this cycle. Falcon is the first market maker to launch a stablecoin.

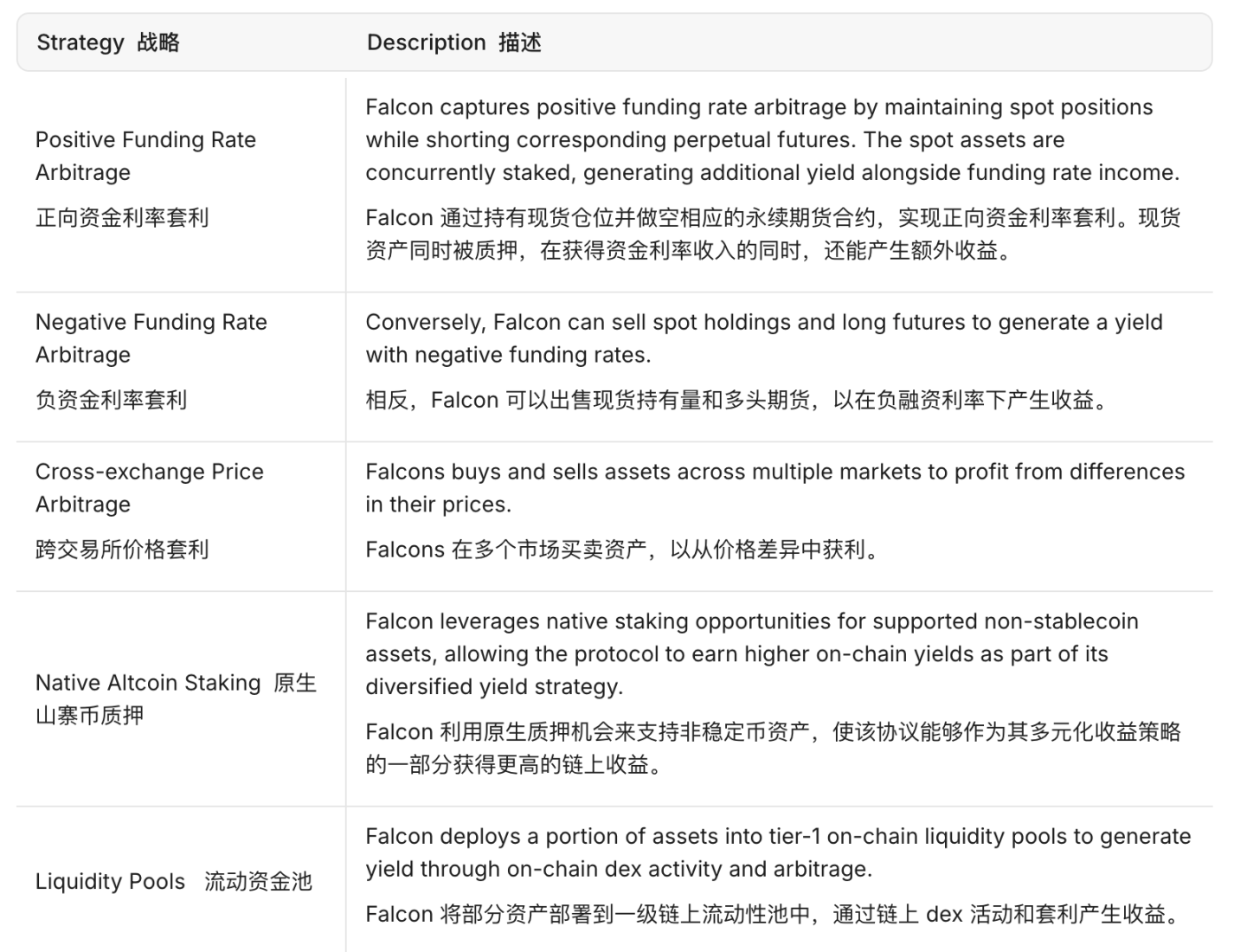

Falcon Finance’s core yield strategy is built on large-scale hedging, much like Ethena. Trading profits are distributed to users, making Falcon an active trading operation wrapped inside a yield-bearing stablecoin. (See: Is ENA’s Stablecoin Model an Innovation or a Valuation Trap?)

The market maker pedigree provides Falcon with inherent advantages in executing trading and yield strategies.

Distinctive Capital

Falcon Finance’s backers set it apart as well.

Falcon Finance is backed by DWF Labs. In April, DWF Labs invested $25 million at an average price of $0.10 in World Liberty Financial (WLFI)—the Trump family’s crypto project—and committed to supporting liquidity for its stablecoin USD1. (Market observers expect DWF Labs to serve as market maker for WLFI tokens.)

On July 30, 2025, Falcon Finance announced a $10 million investment from WLFI, marking WLFI’s first foray into the stablecoin sector. WLFI issues its own dollar-backed stablecoin, USD1, collateralized by U.S. Treasuries and cash. The investment will go toward accelerating Falcon’s cross-chain compatibility and integration between USDf and USD1.

Falcon has confirmed that USD1 has been added to its collateral list, with plans to launch a cross-chain USDf/USD1 swap tool, making the two stablecoins complementary.

WLFI tokens are now trading on Binance’s pre-market contract platform with a fully diluted valuation (FDV) of over $20 billion. Related tokens, such as DOLO, have seen strong recent performance. WLFI’s distinctive capital pedigree gives Falcon a clear conceptual and market edge.

Innovative Model

Falcon’s model—its yield sources and minting mechanism—is truly unique.

Other stablecoin projects, like Ethena’s USDe/sUSDe, also use hedged trading profits as a yield source. Ethena’s USDe is a synthetic dollar, using BTC, ETH, SOL and perpetual futures for delta hedging, plus a basket of mainstream stablecoins for stability—making it fundamentally different from fiat-collateralized stablecoins.

Falcon goes further, leveraging sources like cross-exchange arbitrage and other market maker specialty tactics for a much broader and more complex yield model.

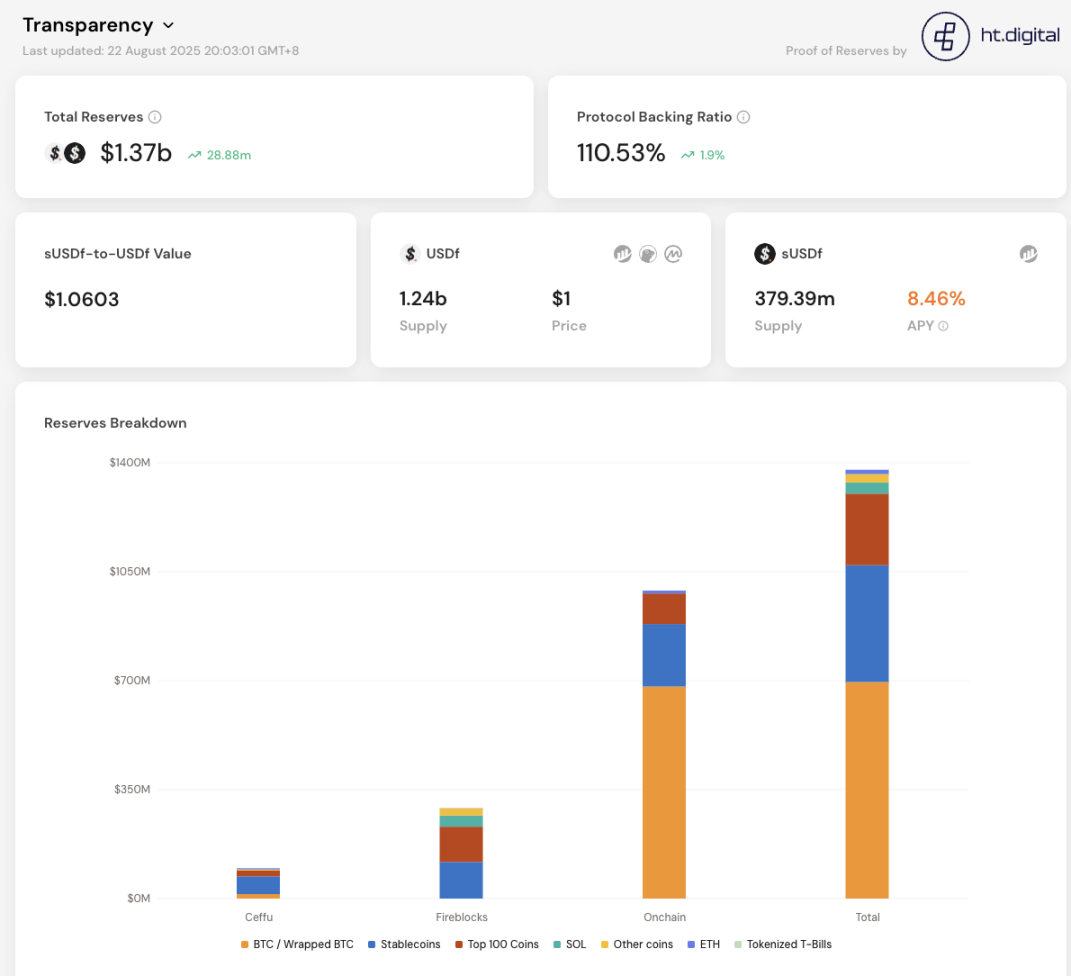

Unlike most stablecoins, USDf is not backed by a single asset. Instead, it uses multi-asset overcollateralization plus hedging: every USDf minted must be backed by more than $1 in collateral, with the collateralization ratio currently running between 110% and 116%.

Falcon’s architecture lets users mint USDf from a wide variety of assets: mainstream stablecoins (USDT, USDC, DAI), leading cryptocurrencies (BTC, ETH, SOL), and select altcoins. Looking ahead, the team plans to add support for tokenized real-world assets (RWAs) and other asset classes.

There are two ways to obtain USDf: mint it via the official Falcon app (requires KYC and a minimum amount, with a choice of “traditional” or “innovative”—option-based—collateralization), or purchase it directly on decentralized exchanges (Uniswap, Curve, etc.), with no KYC or minimums required. In both cases, users earn Falcon Miles points, with higher multipliers for minting USDf by directly collateralizing non-stablecoin assets.

After acquiring USDf, users have multiple ways to participate and earn yield in the Falcon ecosystem:

- Holding rewards—simply holding USDf earns a 6x points bonus daily;

- Staking—stake USDf for sUSDf and earn interest, choosing flexible (base yield) or locked (higher yield) terms;

- Liquidity mining—provide USDf liquidity on leading DEXs (Uniswap, Curve, PancakeSwap) or aggregators (Convex, StakeDAO) to earn trading fees plus up to 40x points;

- Lending and leverage—Falcon has integrated with lending protocols like Morpho, Euler, Silo, allowing users to borrow against USDf or sUSDf and participate in recursive yield farming;

- Yield tokenization—protocols like Pendle enable USDf holders to split future yields, minting “SY/YT” tokens for yield speculation or fixed income. Recommended reading: Pendle Is Hard to Grasp—but Ignoring It Is Your Loss

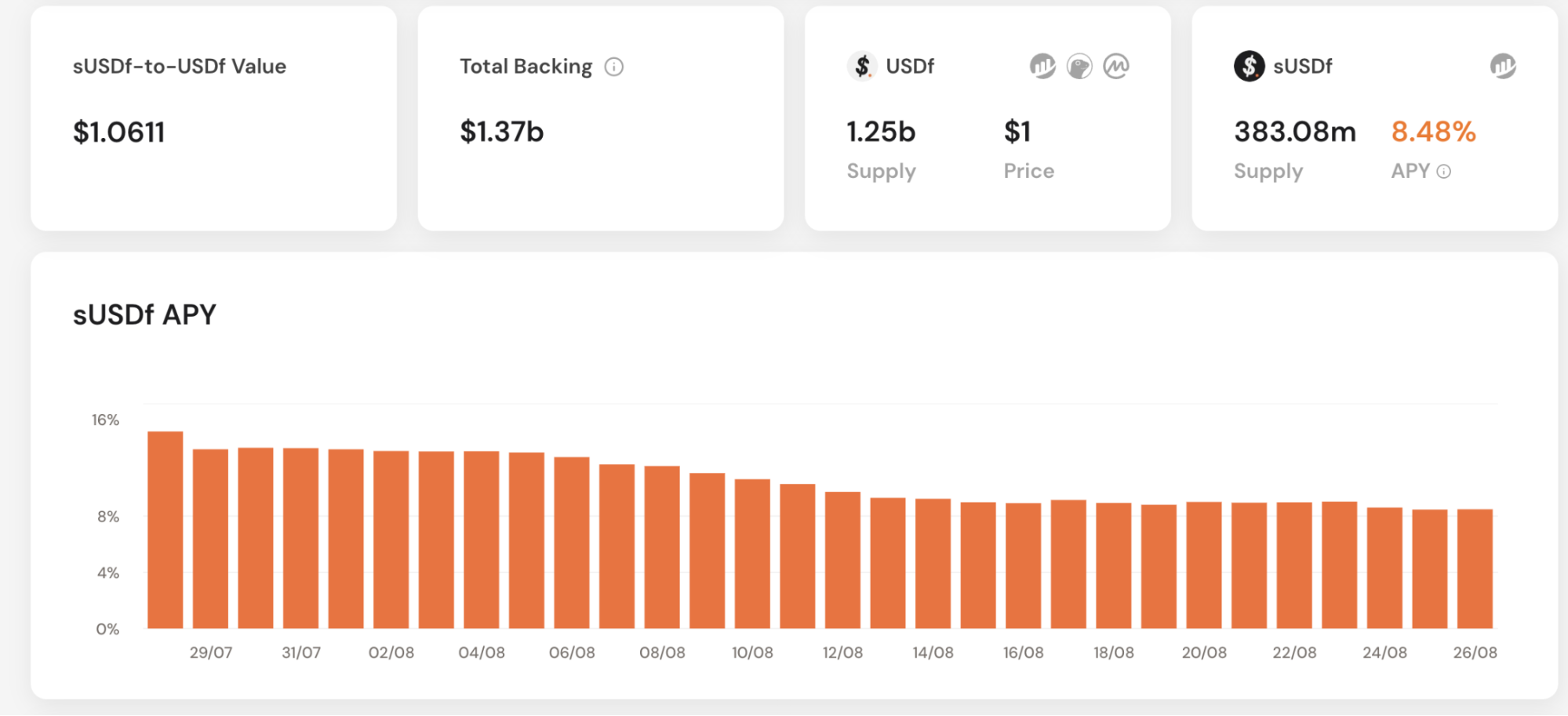

As of August 26, USDf’s circulating supply has reached $1.25 billion, putting Falcon in the top 10 for all stablecoin issuers. sUSDf, the yield-bearing version, counts 383 million tokens outstanding and offers an annualized yield of 8.48%.

A Vision Apart

As noted at the outset, Falcon’s vision transcends stablecoins.

Falcon Finance positions itself as “universal collateral infrastructure,” aiming to transform any custodial asset—crypto, fiat-pegged tokens, tokenized RWAs—into on-chain synthetic dollar liquidity.

Falcon isn’t just launching another stablecoin; it’s building a financial foundation that bridges multiple assets and markets, giving users the ability to enter and exit with any asset, anywhere.

Co-founder Andrei Grachev stresses that USDf’s design goal is to bring traditional financial instruments like U.S. Treasuries and stocks on-chain, generating liquidity and yield.

Falcon approaches this by tightly integrating real-world assets with DeFi (trading, lending, market making) via protocol logic, anchored in robust risk controls and institutional-grade compliance. The team has built out transparency tools such as audit panels and dashboards—for example, the new live dashboard reveals USDf’s 110%+ collateralization, verified via third-party audits. Regular reserve attestations and audit reports are in the pipeline to match institutional standards for safety and compliance.

A Roadmap Unlike Any Other

Given these differences, Falcon’s roadmap looks nothing like a standard stablecoin playbook.

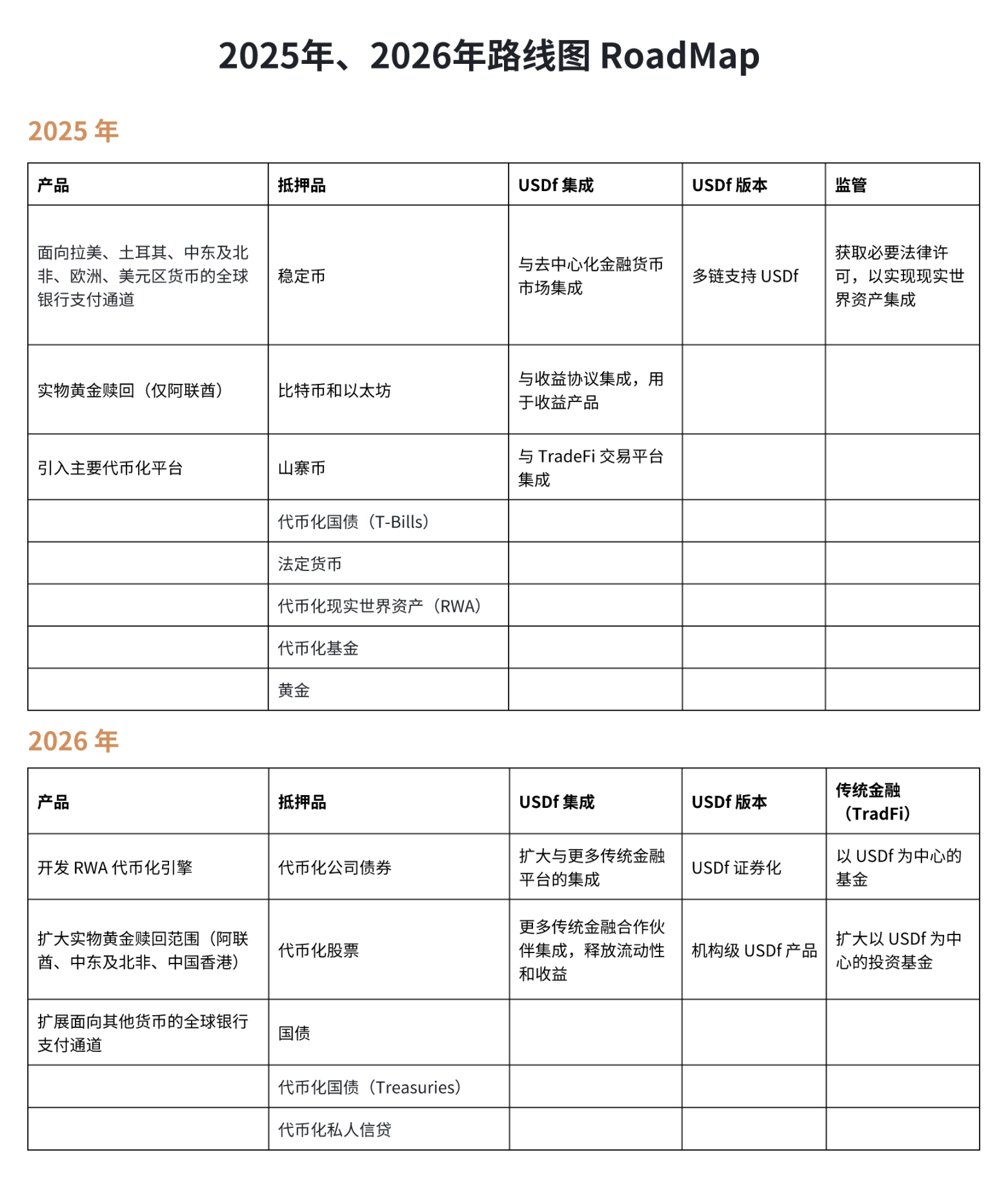

By the end of 2025, Falcon aims to expand fiat channels for dollar liquidity and deploy on multiple chains: regulated fiat on-ramps in major markets like Latin America, Turkey, and the Eurozone; 24/7 instant settlement; and launching USDf on Ethereum L2 and other Layer1/Layer2 public chains to maximize cross-chain capital efficiency.

The team is also working with licensed custodians and payment firms to deliver bank-quality USDf products, such as overnight yield management and money market fund integrations—plus plans for on-chain physical gold exchange in hubs like the Middle East and Hong Kong. By 2026, Falcon will develop a “real-world asset engine” supporting tokenization of corporate bonds, private credit, and launching USDf-based investment and structured securities, targeting large-scale institutional adoption.

Ways to Get Involved

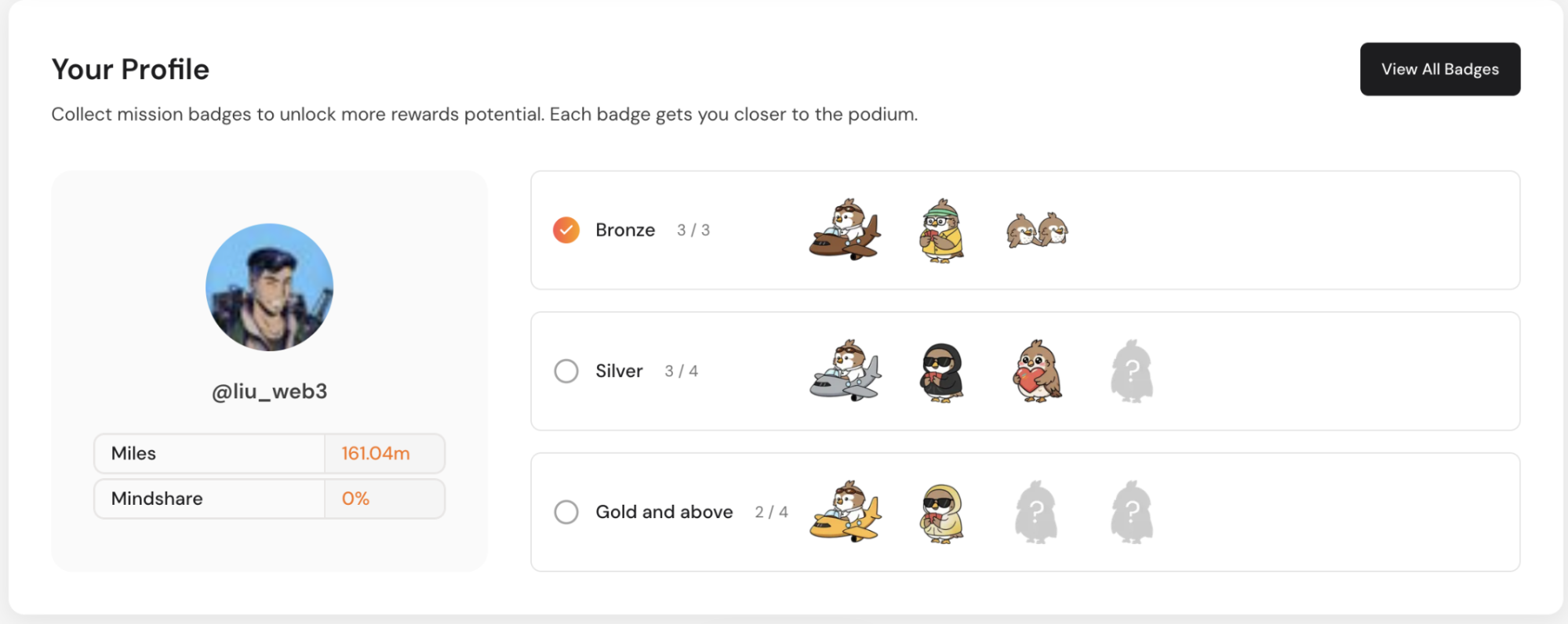

On the community front, Falcon has rolled out incentives to boost participation, including Falcon Miles points and the Yap2Fly social ranking initiative.

Falcon Miles is the project’s points system and is often tied directly to future airdrops—methods for earning points are covered above.

Yap2Fly, a Falcon-Kaito partnership, ranks users by combining their Falcon Miles and Mindshare contributions from social posts. Each month, roughly $50,000 in USDf rewards are split among the top 50 participants, and the badge system unlocks higher rewards and may offer additional bonuses.

In short, Falcon Finance commands over $1 billion in USDf circulating supply and total value locked, making it a leader among synthetic dollar protocols.

What truly sets it apart is its approach: collateralizing large-scale assets for on-chain liquidity, and enabling those assets to generate ongoing yield. The team’s focus on rigorous risk management, compliance, and diversified asset onboarding is designed to appeal to institutional clients rather than just retail DeFi users.

Going forward, Falcon Finance is poised to continue bridging DeFi and traditional finance by expanding its asset classes and deploying across multiple chains.

Disclaimer:

- This article is republished from [Foresight News], copyright held by [Alex Liu, Foresight News]. For objections to republication, please contact the Gate Learn team, which will address concerns promptly according to established procedures.

- Disclaimer: The views and opinions in this article are solely those of the author and do not constitute investment advice.

- Other language versions are translated by Gate Learn. Unless Gate is specifically referenced, translated content may not be copied, distributed, or plagiarized.

Related Articles

Solana Need L2s And Appchains?

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?