Crypto Summer & Global Regulatory Tailwinds: A Comprehensive 2025 Market Cycle Analysis

Historical Background of Crypto Summer and Recovery Characteristics in 2025

Definition and Evolution: “Crypto Summer” has traditionally referred to the recovery phase of the cryptocurrency market during each summer, originating from the natural rhythm of previous bull markets. By 2025, this cycle has matured, driven by favorable policies, market enthusiasm, and technological upgrades.

Source: https://www.gate.com/trade/BTC_USDT

Market Performance Highlights in August: As of mid-August 2025, Bitcoin repeatedly reached new highs, peaking above $124,000, greatly boosting market confidence. Meanwhile, the total market capitalization surpassed $4.1 trillion, mainly due to the influx of large-scale institutional funds and surging trading volumes. Ethereum performed strongly in parallel, with its price approaching $4,780.

Altcoin Season Arrives: Bitcoin’s dominance in total market capitalization (Bitcoin Dominance) declined to about 59.3%, indicating that the bull market has gradually shifted from BTC to altcoins and popular DeFi assets (Altcoin Season).

More Mature Market Structure: Unlike previous cycles driven mostly by retail speculation, this Crypto Summer’s market rise shows more evident structural characteristics: a relaxed macroeconomic environment, increased policy support, accelerated institutional entry, and user participation expanding from mostly retail investors to professional investors and corporate-level funds.

Current Main Drivers of the Crypto Market

Macroeconomic Factors: Loose monetary policies and ample liquidity globally have provided crucial support for the crypto market. Analysts point out that global M3 money supply growth exceeds 9%, and the weakening dollar has created a “liquidity supercycle” that drives the upward trend of crypto assets. Low interest rates and a loose credit environment also guide funds to seek higher returns, with crypto assets becoming target assets due to their scarcity and high return potential.

Institutional Capital Involvement: From 2024 to 2025, institutional investment accelerated its entry into the market. New products like spot Bitcoin ETFs brought unprecedented capital inflows, with net inflows of about 51,500 BTC in December 2024, triple the new mining output that month, pushing up Bitcoin prices. Meanwhile, many large asset management firms and public companies also joined the ranks of Bitcoin holders: BlackRock’s Bitcoin ETF holds over 662,500 BTC, while Fidelity and public company financial reports disclosing crypto asset investments further solidified market confidence.

Technological Evolution and Innovation: Blockchain technology progress is also a driving force. Networks like Ethereum continue to upgrade (e.g., the Shanghai upgrade introducing staking withdrawals), Layer 2 scaling projects (Arbitrum, Optimism, zkSync, etc.) grow rapidly, effectively improving transaction rates and reducing costs, significantly enhancing the scalability of DeFi, NFTs, and blockchain games. Additionally, improvements in cross-chain bridges and smart contract platforms attract more developers and users.

User Behavior Changes: Retail investor interest has rebounded significantly. As of the first half of 2025, about 80% of Bitcoin ETF inflows came from retail investors. Social media buzz and the popularity of mobile payment wallets have brought more ordinary users into the market. Unlike simple speculation in the past, current users are more focused on on-chain yields (such as staking rewards, token dividends) and practical application scenarios, making the market structure healthier.

Positive Shifts in Global Crypto Asset Regulatory Environments: US GENIUS Act, European MiCA, and Asian Compliance Openness Trends

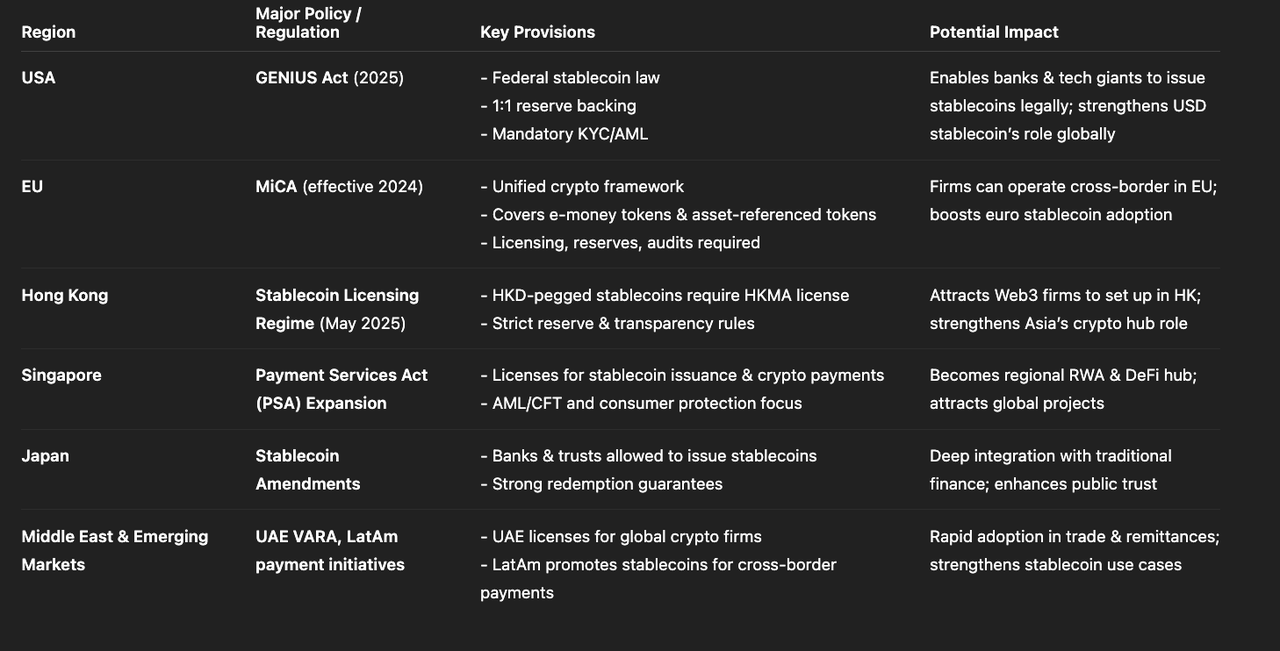

Overview of Crypto Asset Regulatory Policies Worldwide (Source: Gate Learn Creator Max)

US GENIUS Act: In July 2025, the US President signed the Guaranteeing Economic Norms and Innovative Ubiquitous Stability Act (GENIUS Act), the first federal regulation for stablecoins in the US. This act establishes clear rules for issuing and operating USD-pegged stablecoins, requiring issuers to hold 1:1 USD equivalent asset reserves and comply with anti-money laundering (AML) and know-your-customer (KYC) regulations. This move not only brings regulatory transparency to the stablecoin market but also encourages banks and tech giants to explore digital asset businesses within a compliant framework.

European MiCA Regulations: The Markets in Crypto-Assets Regulation (MiCA) that came into effect in the EU in December 2024 provides unified regulatory standards for crypto assets, including stablecoins. According to MiCA, strict capital reserve ratios, issuer licensing, and regular audits are required for stablecoins pegged to fiat currencies like the euro (“e-money tokens”) and those backed by a basket of assets (“asset-referenced tokens”). The implementation of MiCA allows crypto businesses within the EU to operate across borders with a “passport,” helping to attract legitimate innovative projects.

Asian Compliance Trends: The regulatory environment in Asian markets is generally improving. Hong Kong introduced a stablecoin licensing regime in May 2025, requiring all companies issuing HKD-pegged stablecoins to apply for a license from the HKMA and hold sufficient reserves. Singapore and Japan are also accelerating legislation: the Monetary Authority of Singapore has issued over 30 licenses for crypto payment and stablecoin businesses; Japanese regulatory authorities are actively improving regulations on crypto trading and financial products. Analysis firms point out that Hong Kong, Singapore, Japan, and other Asia-Pacific countries have made stablecoin regulation a priority, further enhancing investor confidence in the market’s healthy development.

Compliance and Institutional Dominance Trends in the Stablecoin Market

Policy Push

With the introduction of regulations like the GENIUS Act, the stablecoin market is accelerating towards compliance. Reuters reports that several large financial firms (such as Bank of America, Wells Fargo, payment service provider Fiserv, etc.) have begun planning to issue their own USD stablecoins. These companies hope to achieve cross-border payments and instant settlements through stablecoins but must also comply with new regulatory requirements.

Issuance Requirements

The latest regulations clearly state that compliant stablecoin issuers must meet strict conditions, including 1:1 asset backing (such as USD, US Treasury bonds, or other highly liquid assets), regular public audits, and strict KYC/AML measures. This gives traditional financial institutions with existing banking licenses and comprehensive compliance systems a clear advantage, while general crypto companies face high capital and operational barriers if they want to issue stablecoins.

Market Landscape

As regulations become clearer, the market shows a trend towards dominance by compliant institutions. For instance, reports indicate that executives from major banks like Bank of America and Citigroup are actively considering issuing compliant USD stablecoins. Meanwhile, large internet and retail companies (such as Walmart, Amazon) are also researching the use of stablecoins to improve supply chain and cross-border payments. Overall, the future stablecoin market may form around leading institutions with strength and credibility, with compliance and usability as core competitiveness.

Comprehensive Overview of Popular Tracks: Layer2, RWA, DePIN, AI + Blockchain, NFT and Blockchain Gaming Recovery

Current Popular Tracks Panorama (Source: Gate Learn Creator Max)

Layer2 Scaling Projects

Layer 2 networks of public chains like Ethereum (such as Arbitrum, Optimism, zkSync, etc.) continue to develop rapidly, greatly improving on-chain transaction speeds and reducing fees. Many DeFi protocols and game projects are migrating to Layer 2, thus alleviating main network congestion and improving user experience. These technological upgrades have driven the activity of Ethereum ecosystems and other smart contract platforms.

Real World Asset Tokenization (RWA)

The RWA sector has seen explosive growth in recent years. By 2025, the total scale of RWA tokens has skyrocketed from $8.6 billion at the beginning of the year to $23 billion, a growth rate of 260%. Private credit and US Treasury bonds have become the main linked assets. BlackRock’s on-chain Treasury fund (BUIDL) grew from $649 million to $2.9 billion within the year, offering staking and lending services through DeFi protocols like Euler. Such projects bring traditional assets on-chain, not only injecting reliable yields into the on-chain ecosystem but also promoting further integration of compliant and financial institutions.

Decentralized Physical Infrastructure Networks (DePIN)

DePIN projects participate in the construction and operation of physical infrastructure through token incentives. For example, the Helium network is deployed by users who set up wireless hotspots and receive token rewards. By 2024, the total market value of the DePIN sector had reached about $25 billion, with over 13 million devices contributing computing power or services to various DePIN projects daily. Government departments are also beginning to view DePIN as a solution for infrastructure maintenance, with some regions’ public projects collaborating with DePIN teams. Although DePIN is still in its early stages, its decentralized approach and integration with the real economy are noteworthy.

AI + Blockchain

The fusion of artificial intelligence and blockchain is considered one of the important future trends. AI technology can be used for smart contract automation (e.g., self-adjusting based on market conditions) and on-chain data analysis (such as real-time fraud detection), while blockchain provides traceable data sources and incentive mechanisms for AI models. For example, decentralized oracles like Chainlink are exploring integrating multiple AI model results into smart contracts, aggregating answers through decentralized networks to improve output credibility. Additionally, some projects are attempting to combine AI computing power with blockchain economics, providing token rewards for AI model training or services. Overall, innovations in the AI + blockchain field may catalyze new applications and token value.

NFT and Blockchain Gaming Recovery

After a long period of stagnation, the NFT and blockchain gaming markets show signs of recovery in 2025. The total value of the NFT market has rebounded to over $9 billion. For example, in July 2025, the monthly NFT transaction volume was about $574 million, the second highest of the year, mainly due to the rise in Ethereum prices driving up the valuation of collectibles. Meanwhile, traditional industries are beginning to re-adopt NFTs: luxury brands and game developers are using NFTs for digital identity authentication and community operations, exploring new business models. In blockchain gaming, there were about 5.8 million daily active wallets in the first quarter of 2025, and some popular projects (such as “World of Dypians”) released new versions featuring AI-enhanced gameplay. Furthermore, several venture capital firms and funds are increasing their investments in Web3 gaming infrastructure and emerging NFT projects. Overall, the NFT and blockchain gaming sectors are transitioning from quantitative to qualitative changes, with focus gradually shifting to gameplay innovation and real user needs.

How Investors Can Identify “False Recoveries” and Sustainable Opportunities

Beware of Bull Traps

“False recoveries” often manifest as a brief price increase after a bear market ends, where the market shows a seemingly “breakthrough” trend but quickly falls back. Technical analysis points out that such bull traps usually occur in the early stages of a market rebound, giving the illusion of a series of higher highs. Investors should pay attention to signals like trading volume: if volume doesn’t increase as prices rise, or if there’s a sharp pullback after a rapid surge, these are often typical characteristics of a false rally. In such situations, caution should be maintained, avoiding chasing high prices.

Technical Indicators and Stop-Loss Strategies

When judging whether a trend is sustainable, technical indicators can be used for filtering. For example, use moving average breakouts and support levels to judge breakthrough strength; if the Relative Strength Index (RSI) is in the overbought zone without further volume expansion, caution is also needed. Investors can set stop-loss points or wait for the bullish trend to be confirmed over multiple days before entering positions to reduce risk. Meanwhile, diversifying investments across different assets (such as various mainstream coins and sectors) is an effective method to combat market volatility.

Fundamental Assessment

Sustainable rallies are usually accompanied by real project progress and user growth. Investors should focus on fundamental factors such as the application scenarios behind projects, development teams, and community activity. If a token’s price surges but lacks substantial support in terms of technical roadmap, user base, or revenue prospects, skepticism is warranted. Conversely, projects that can provide tangible economic value or replace traditional services are more likely to gain long-term favor. In short, distinguishing “false recoveries” requires differentiating between speculative atmosphere and real value implementation, and focusing on on-chain data (such as active address count, locked value) is often an effective approach.

Market Risks and Future Outlook: Bubbles, Regulatory Uncertainties, and Quantum Security Concerns

Bubble Risk

There are serious bubble concerns when the market overheats. Some macroeconomic analysts warn that if the bull market inflates excessively, the total market value of crypto assets could reach a staggering $12.95 trillion by the end of 2025, then potentially crash rapidly to just $93 billion. This pessimistic prediction reminds us that even amidst a bull market, we should remain cautious about excessive speculation. Investors need to always remember that each bull market may be followed by a significant correction.

Regulatory Uncertainties

Although the global regulatory environment is improving, policy differences still exist among countries. The WEF points out that major markets like the US, EU, and Asia still need to further coordinate regulatory details. Any sudden turns in regulatory stances could lead to dramatic market fluctuations. For example, China’s strict limitations on crypto trading, the future regulatory direction in the US, and policy changes in other countries can all impact investor sentiment and market liquidity. When positioning, it’s necessary to closely monitor global regulatory developments.

Quantum Computing Threat

In the long term, quantum computing technology is a major security concern for crypto assets. Security experts warn that once quantum computers reach sufficient power, existing elliptic curve encryption algorithms could be broken instantly. Currently, about 30% of Bitcoin holders have their address public keys exposed on-chain, making these assets most vulnerable to future quantum attacks. Although the industry generally believes that mainstream blockchains have time to deploy quantum-resistant solutions (such as switching to post-quantum algorithm addresses), investors should also pay attention to cryptographic advancements and timely update wallets and transfer assets to more secure solutions.

Future Outlook

Overall, the crypto market in 2025 is more mature in terms of policy and technology compared to previous years, but caution is still necessary. As regulatory frameworks are implemented and infrastructure improves, the market may maintain a growth trend in the medium to long term, but short-term volatility remains. Investors should adhere to value investing and risk management: focus on market fundamentals, project innovation, and diversified positioning, avoiding being misled by short-term fluctuations. Only in this way can sustainable opportunities be captured in the waves of Crypto Summer.

Related Articles

Solana Need L2s And Appchains?

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?