Pendle x Terminal Finance

Pendle’s early integration with Terminal Finance is more than just another ‘yield opportunity’.

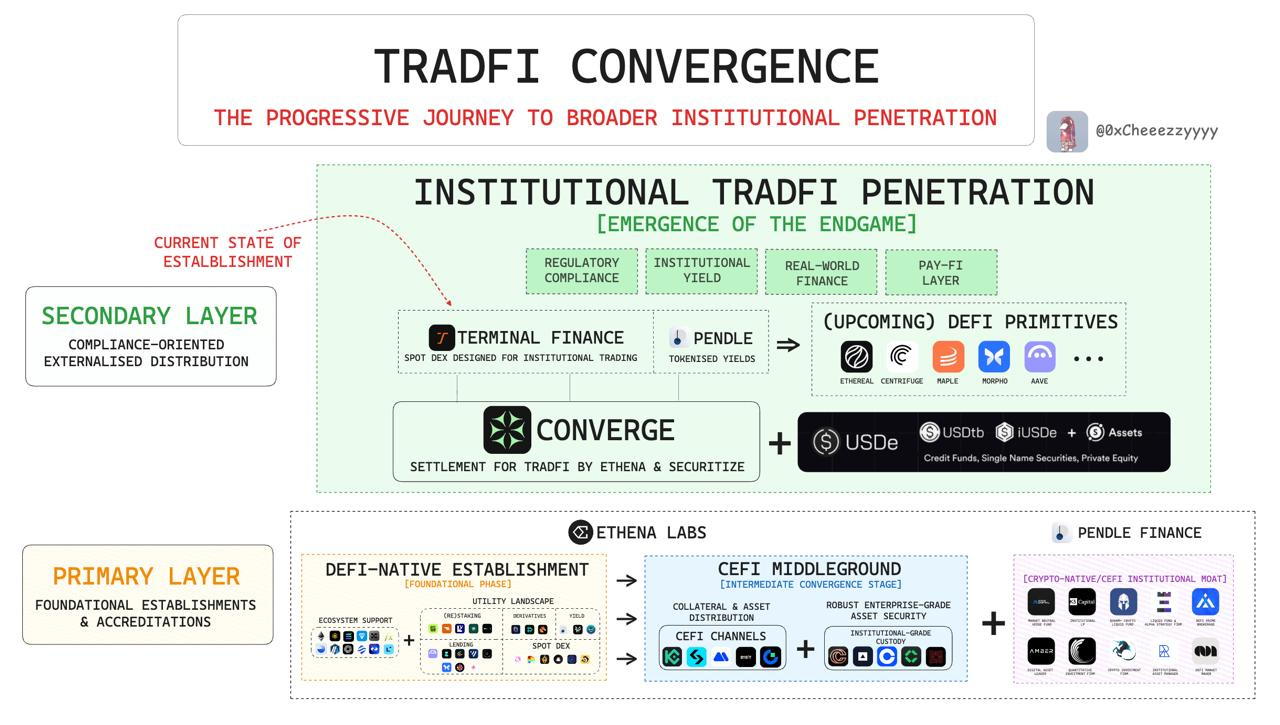

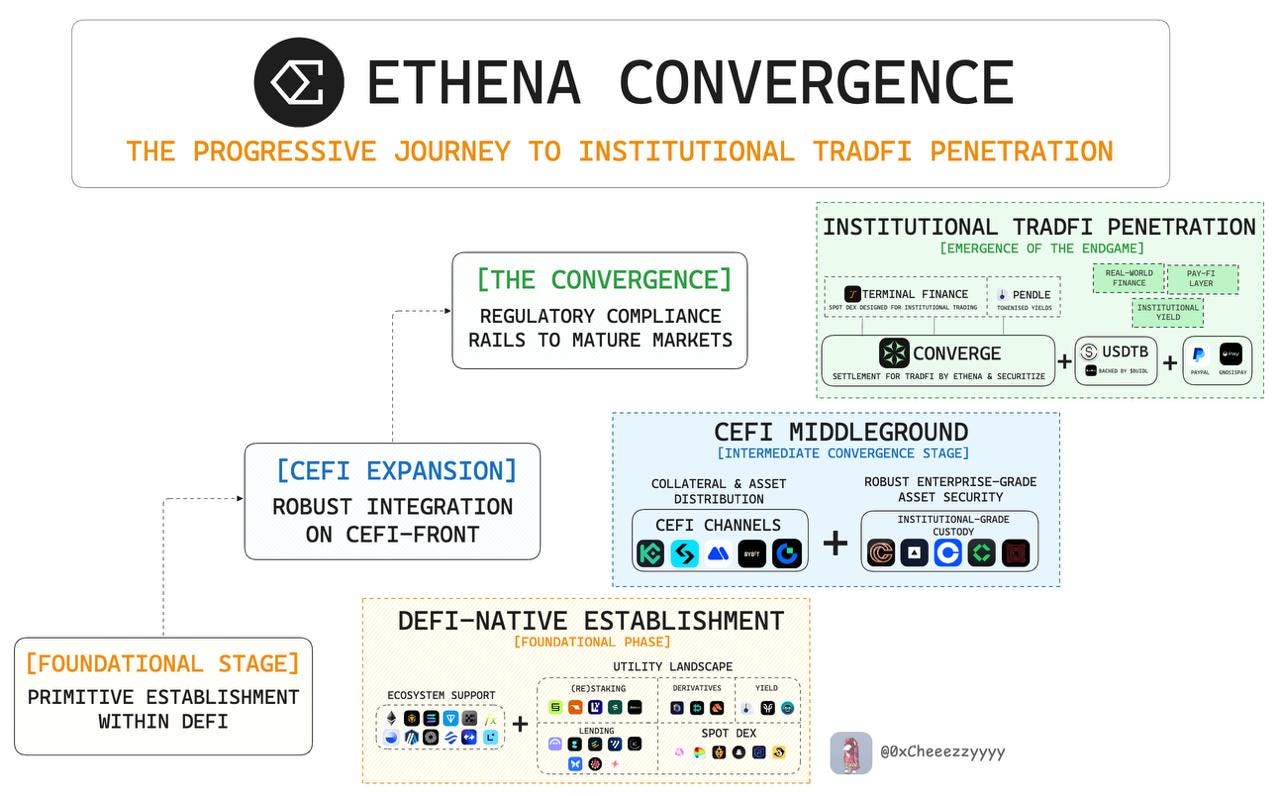

This signals the dawn of a new financial era:

The convergence of TradFi <> DeFi-native primitives at the most foundational level.

This is herald by Converge: a strategic TradFi-oriented partnership with Ethena and Securitize well-positioned for institutional money.

The motivation stems from a strong ‘new’ thesis for institutional adoption as TradFi start recognising the the powerful synergies DeFi unlocks.

The Converge ecosystem is led by some of the most institutionally-aligned forces in DeFi starting off with Terminal Finance, capitalising on Ethena & Pendle at the forefront.

Its credibility stems not just from speculative traction, but from a well-engineered financial stack:

- DeFi-native foundations with deep integrations + composability

- Strong CeFi externalised distribution

- Closed-loop institutional participation

All of this adds up to a robust primary layer that cements the structural groundwork for the wider institutional access.

The Next phase: Secondary Layer Formalisation

This marks the final stage of externalisation towards a fully TradFi-attuned ecosystem, built on:

- TradFi strategic distribution

- Regulatory compliance architecture

- Institutional-grade liquidity coordination

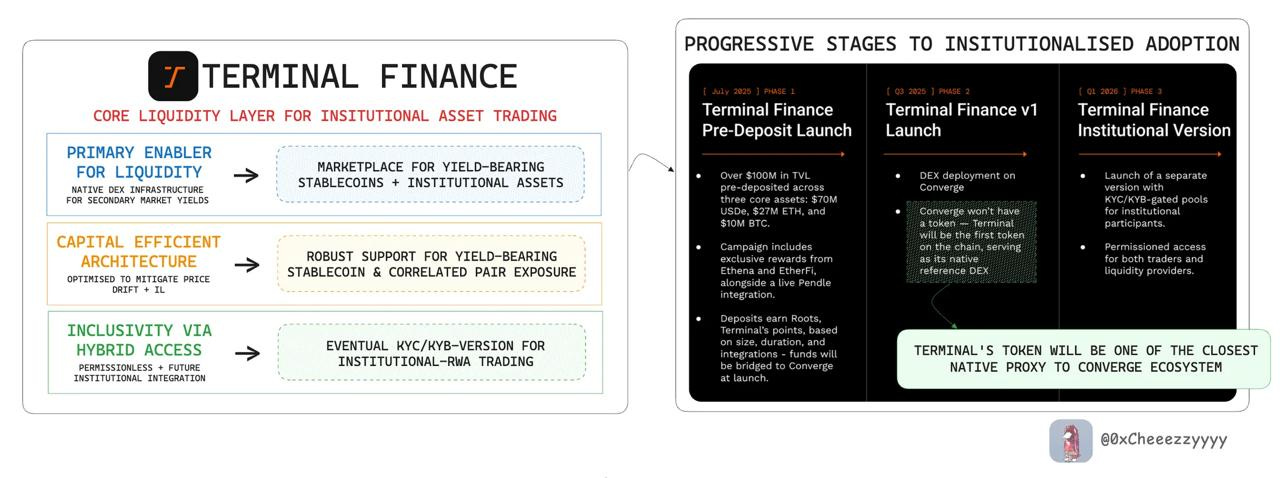

With a bottom-up approach, Terminal Finance serves as the core anchor to Converge’s TradFi-oriented liquidity hub of this whole financial stack designed for institutional trading.

The entire ethos of ‘Money Legos’ that defined early DeFi was built on one principle: composable liquidity.

But composability means nothing without accessible, deep & reliable liquidity. That’s exactly where TerminalFi steps in as a cornerstone of the Converge ecosystem.

Far more than just another DEX, it is engineered to be:

- Primary Ecosystem Enabler → Robust secondary marketplace tailored for institutional-grade assets & yield-bearing stablecoins

- Capital Efficient → Optimised design via mitigating price drift + IL for superior liquidity provision returns

- Inclusive Accessibility → Both permissionless & eventually KYC/KYB-version for compliant institutional RWA trading

It’s clear that Terminal is purpose-built as an institutional-grade primitive, offering a distinct & compelling value proposition.

Moreover, in the absence of a token roadmap from Converge, Terminal effectively serves as the nearest native proxy for capturing Converge’s potential upside.

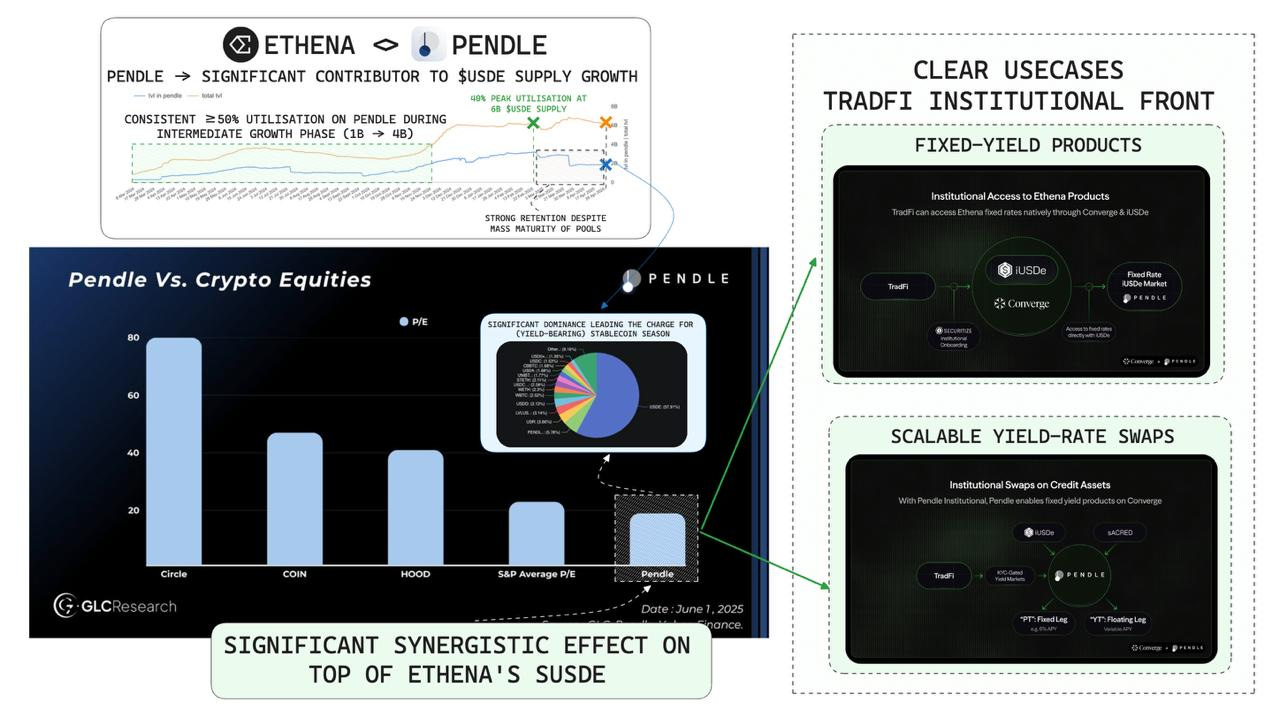

On Choosing a Strategic Dual-Synergy: Pendle x Ethena

Terminal’s YBS thesis led to a strategic choice of sUSDe as the base asset, while launching in-tandem with Pendle on day-1 cements this alignment.

And it’s no coincidence at all.

While @ethena_labs scaled to over $6B supply in under a year, Pendle Finance has been instrumental in this growth:

- Over 50% of sUSDe supply was tokenised through Pendle during the climb from $1B → $4B

- 40% peak utilisation at $6B supply

This level of retentive utilisation on Pendle proves market fit for tokenised yield (fixed & variable) within DeFi-native portfolios. More importantly, it highlights the powerful, mutually reinforcing synergy between Ethena and Pendle: fuelling an enduring cycle of compounding network effects that continually scales and amplifies their impact across the ecosystem.

But the synergy doesn’t stop there.

Ethena & Pendle are poised to go far beyond DeFi users. Together, they aim directly at the institutional opportunity:

- Fixed-Yield Products ($190T market in TradFi)

- Interest Rate Swaps (Even larger $563T market segment)

Through Converge’s accredited & regulated distribution channel, the missing bridge to institutional allocators through is now in place. This unlocks broad access to crypto-native return sources that are faster, composable & yield-centric by design.

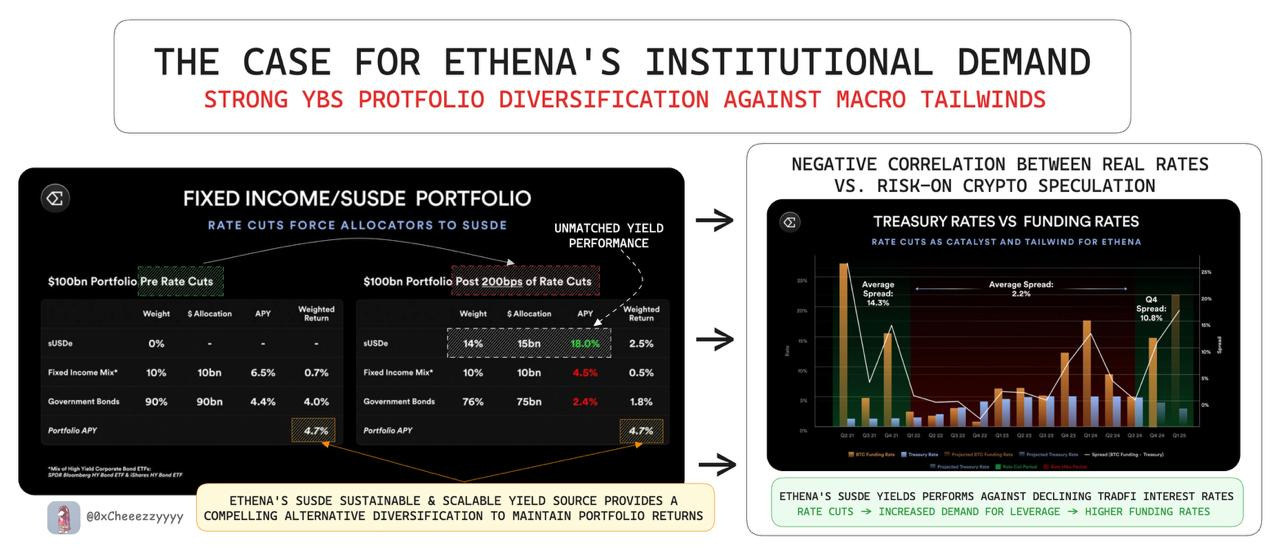

This thesis only works if it is built on an innovative financial primitive aptly designed against incoming macro-tailwinds & Ethena’s sUSDe fits perfectly:

sUSDe returns are negatively correlated to real global rates unlike another other debt instrument in legacy finance.

This means sUSDe not only survives a shifting rate environment, but thrives in it.

With cur. rates (~4.50%) expected to fall, institutions are bound to face portfolio compression—cementing sUSDe’s positioning as a logical alternative for funds to preserve portfolio returns.

In both 2020/21 & Q4 2024, BTC funding spreads relative to real rates exceeded 15%.

What does this means?

sUSDe & by extension iUSDe (TradFi-wrapped version) are structurally superior from a risk-adjusted yield perspective. Coupled with significantly lower cost of capital (vs. TradFi), there’s potentially a 10x interest from the untapped TradFi world.

The Dual-Synergistic Growth Effect: Pendle’s Critical Role

The Next Phase: Convergence

It’s evident that both Ethena & Pendle are strategically aligned with roadmaps towards same ultimate goal: TradFi Convergence.

Since its inception from Q1 2024, Ethena has successfully solidified its DeFi-native presence + CeFi middle-ground with robust establishments:

- USDe and sUSDe asset availability across >10 ecosystems + top-tier DeFi integrations

- Multiple CeFi distribution channels via CEXs for adoption + collateral utility on perps

- Payments layer integration like PayPal and Gnosis Pay

The foundation has been laid for the final stage of institutional TradFi penetration, and the birth of Terminal Finance serves as the core anchor to Converge TradFi-oriented liquidity hub for institutional trading.

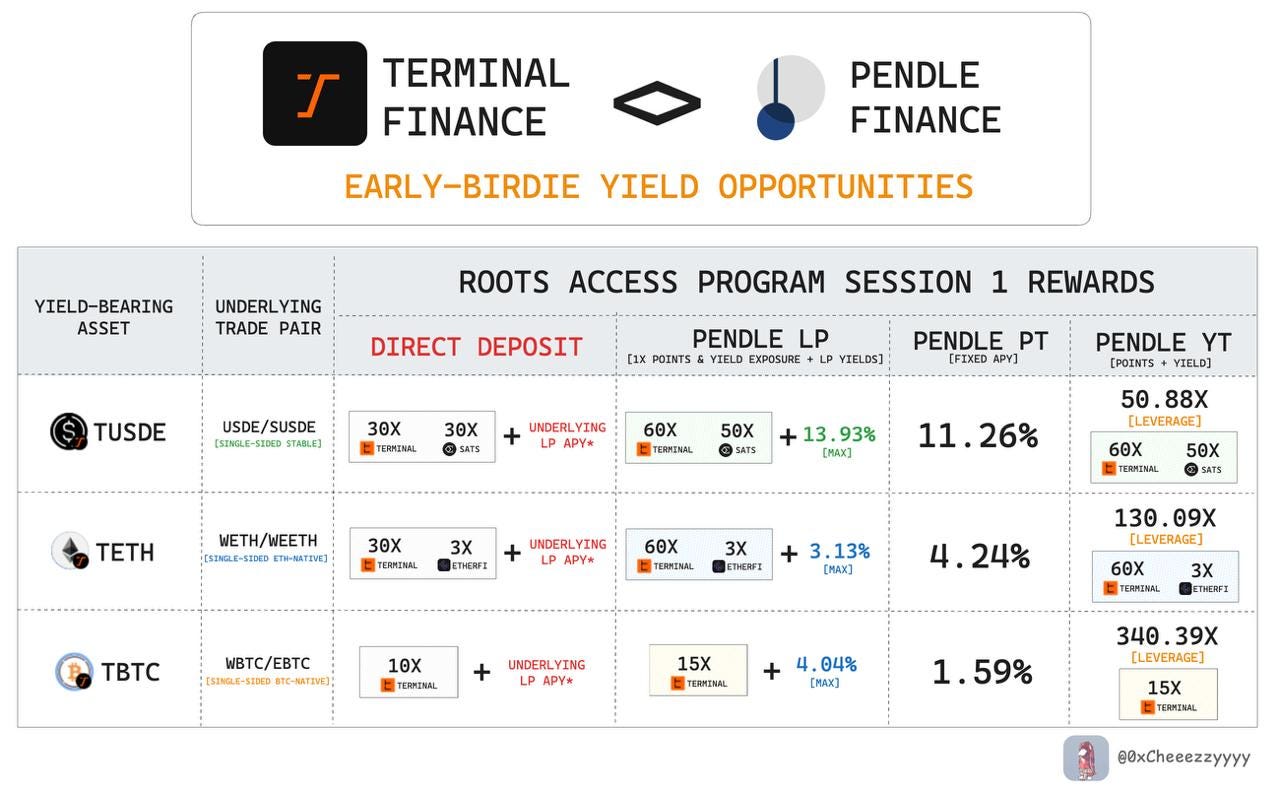

Needless to say, Pendle’s involvement which unlocks financial potential from the YBS primitive. This simultaneously comes with Pendle’s launch on pre-deposit for LP tokens for initial pools:

- tUSDe: sUSDe/USDe pool

- tETH: wETH/weETH (by EtherFi) pool

- tBTC: wBTC/eBTC (by EtherFi) pool

*These pools are uniquely designed for single-sided beta exposure + minimising IL risk for convicted & retentive LP-ing.

On Early Opportunities: Roots Access Program Phase 1

The early bootstrapping phase comes with exclusive multipliers on Pendle which are time-sensitive:

- 15x-60x multiplier on Terminal Points (vs. 10-30x on direct deposit)

- 50x Sats multiplier for tUSDe & 3x EtherFi multiplier for tETH

- Up to 13.93% LP APY on top of yield + points with single-sided exposure & negligible impermanent loss

- 11.26% fixed APY on tUSDe

- Highly capital efficient YTs exposure → 51%–340% (on yield + points)

Clearly, there is no other avenue offering such strategic opportunities on an early emerging institutional primitive.

Final Thoughts:

Zooming out, Converge establishment signifies the financial OS for the next economic primitive.

In case you still can’t see it:

- Ethena brings the yield-bearing dollar

- Pendle enables the yield structuring layer

- Terminal leads the institutional market access

Together, they form the backbone of a one-of-a-kind on-chain interest-rate system that is composable, scalable & ready to meet the trillions in global fixed income seeking better yield.

This is the real unlocking of institutional DeFi.

And it’s already begun.

Disclaimer:

- This article is reprinted from [Substack]. All copyrights belong to the original author [Cheeezzyyyy]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

Solana Need L2s And Appchains?

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What Is Ethereum 2.0? Understanding The Merge