- Topic

6k Popularity

5k Popularity

39k Popularity

448 Popularity

42k Popularity

9k Popularity

17k Popularity

6k Popularity

3k Popularity

95k Popularity

- Pin

- 🚨 Gate Alpha Ambassador Recruitment is Now Open!

📣 We’re looking for passionate Web3 creators and community promoters

🚀 Join us as a Gate Alpha Ambassador to help build our brand and promote high-potential early-stage on-chain assets

🎁 Earn up to 100U per task

💰 Top contributors can earn up to 1000U per month

🛠 Flexible collaboration with full support

Apply now 👉 https://www.gate.com/questionnaire/6888

- 🔥 Gate Square #Gate Alpha Third Points Carnival# Trading Sharing Event - 5 Days Left!

Share Alpha trading screenshots with #Gate Alpha Trading Share# to split $100!

🎁 10 lucky users * 10 USDT each

📅 July 4, 4:00 – July 20, 16:00 UTC+8

Gate Alpha 3rd Points Carnival Issue 10 is in full swing!

Trade and post for double the chances to win!

Learn more: https://www.gate.com/campaigns/1522alpha?pid=KOL&ch=5J261cdf

- 🎉 [Gate 30 Million Milestone] Share Your Gate Moment & Win Exclusive Gifts!

Gate has surpassed 30M users worldwide — not just a number, but a journey we've built together.

Remember the thrill of opening your first account, or the Gate merch that’s been part of your daily life?

📸 Join the #MyGateMoment# campaign!

Share your story on Gate Square, and embrace the next 30 million together!

✅ How to Participate:

1️⃣ Post a photo or video with Gate elements

2️⃣ Add #MyGateMoment# and share your story, wishes, or thoughts

3️⃣ Share your post on Twitter (X) — top 10 views will get extra rewards!

👉

What are the expected dividend stocks and the reason for the 40% savings rate? A solid investor, caregiver Man-san, steadily accumulating investment returns [Part 2] | Learn from the Masters "Money's Way" | Moneyクリ Monex Securities' investment information and money-related media

In 2020, retail investor and caregiver Man started investing in dividend stocks with an initial capital of 4 million yen, and after about 5 years of investment, he reached a financial asset of approximately 36 million yen. In the first part, we discussed his investment methods and stock selection strategies, focusing on high-dividend stocks, within a family income of 3.5 million yen and a household income of 5.5 million yen. In the second part, we will delve into promising dividend stocks, ways to utilize the new NISA, and investment rules.

Orix (8591), Hulic (3003), National Guarantee (7164) and other promising stocks

――Are there any individual stocks among your current holdings that you are optimistic about?

All the companies I hold are expected to perform well, but if I were to mention a few, Orix (8591) has clearly stated in its final financial results for May 2025 that it aims for a net profit of 1 trillion yen by the fiscal year 2034. This is a plan to increase nearly threefold, but shareholder returns are welcomed, so I continue to buy more while looking forward to the future.

Hulic (3003), which has achieved 16 consecutive years of increased profits and dividends, is actively engaging in new developments such as the opening of a new parenting base "Kodomo De Part" and expanding its business overseas, making its aggressive M&A activities stand out. There is always some topic to note every time I read the financial statements, so I am looking forward to what is to come.

National Guarantee (7164) has achieved record profits for 13 consecutive terms and is actively engaging in M&A as well. There is a movement for restructuring in the industry itself, and the independent National Guarantee seems to be conducting appealing M&A, as it records negative goodwill every year. With stability in its stock business and a high dividend increase rate, there are also expectations.

Paramount Bed Holdings (7817), the leading company in medical and nursing beds in Japan, is a company I am also grateful to in my work. In addition to contributing to a super-aged society, it left a good impression that the target level for dividends was raised as part of shareholder returns in the final financial results in May. The shareholder benefit QUO card is also nice.

NTT (9432), which is advancing the "IOWN" initiative using cutting-edge optical technology, is also attracting attention. Although the stock price has been soft since 2024, personally, I am happy to buy at a low price and do not feel anxious in the long term.

I have about 5 years of investment experience, and I feel that just steadily buying large-cap stocks that represent Japan can yield solid returns. I believe that by trusting in the businesses of companies that are essential to Japan, investing properly while diversifying, and enjoying the benefits of shareholder returns, I can steadily build my assets without needing to take unusual approaches or try to be original.

The policy is to fill the NISA growth investment limit of 4.8 million yen (for a couple).

――How are you planning to utilize the "New NISA" that started in 2024?

In the new NISA, there is a 1.2 million yen accumulation investment limit and a 2.4 million yen growth investment limit, allowing a couple to utilize a total of 7.2 million yen in tax-exempt limits annually. In our household, we manage our finances together as a couple to generate investment funds.

The main focus is on a growth investment account, and I am investing in a way that allows my spouse and me to fill the 4.8 million yen limit within a year. Since our household income is less than 6 million yen, filling the 4.8 million limit is a reckless level, but I am trying to maximize the limit by selling stocks in my specified account and repurchasing them with NISA, as well as redirecting any temporary income into investments.

The積立 investment limit is only 1,000 yen per month for 2 people. I think it's perfectly fine not to invest at all, but I am still investing just 1,000 yen as a precaution.

――What about the old NISA portion?

In the old NISA, I have been investing in index funds, and I hope that this can cover my children's education expenses. I am considering iDeCo as a supplement for my retirement.

At the moment, I feel that I don't need to worry too much about future preparations, so I am investing in NISA with the mindset of improving my current life, increasing dividends to create memories with my family, and increasing the money I can use freely.

About 70% of Japan's High Dividend Stocks, Latest Portfolio with Less Cash

――Please tell us about your latest asset portfolio.

The foreign stock index fund accounts for about 23%, Japanese high-dividend stocks for about 67%, and cash for around 10%, indicating a lower cash level. Since we are primarily investing in Japanese high-dividend stocks, we expect the ratio to become increasingly skewed in the future.

――When is the right time to change asset allocation?

I am consciously aiming to maximize dividends, so I don't think too much about asset allocation. However, as I age, the number of working years will naturally decrease, so in the future, I plan to increase the proportion of cash with aging.

Currently, I am mainly investing in high-dividend stocks in Japan through the NISA growth account, but after the growth account is filled, I am considering increasing my investment slightly in foreign stock index funds to fill the accumulation investment account.

――I hear that you are conscious of a "savings rate of 40%" in household management. Could you tell me the reason for that?

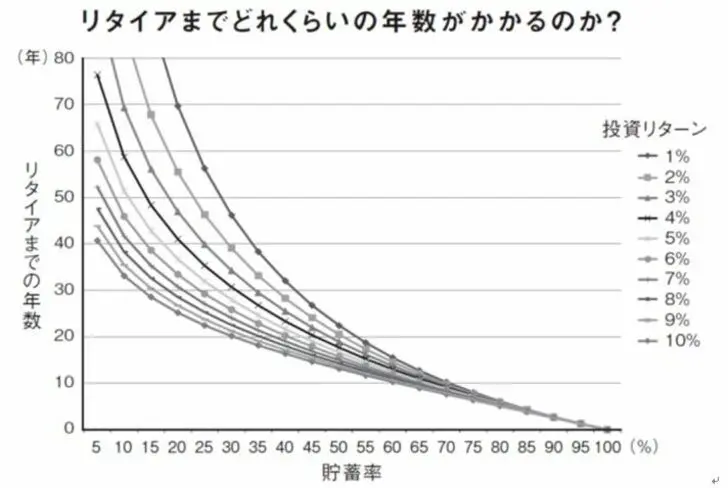

A savings rate of 40% serves as a clear standard for managing household finances. In the book "FIRE: The Ultimate Guide to Early Retirement" (Authors: Kristy Shen & Bryce Leung, Diamond Publishing), there is a graph showing how the combination of savings rate and investment returns determines how many years it will take to reach retirement.

[Chart] Savings Rate and Years Until Retirement Source: Diamond Inc. "FIRE: The Ultimate Method to Become Free from Money in the Fastest Way"

Looking at this graph, it becomes clear that increasing the savings rate shortens the time until retirement more than raising investment returns. For example, even when comparing with an investment return of 5%, it takes 35 to 40 years with a savings rate of 20%, but with a savings rate of 40%, one can retire in 20 to 25 years.

Source: Diamond Inc. "FIRE: The Ultimate Method to Become Free from Money in the Fastest Way"

Looking at this graph, it becomes clear that increasing the savings rate shortens the time until retirement more than raising investment returns. For example, even when comparing with an investment return of 5%, it takes 35 to 40 years with a savings rate of 20%, but with a savings rate of 40%, one can retire in 20 to 25 years.

Additionally, it can be seen from the graph that if the savings rate is raised too much, the effect gradually diminishes. Raising the savings rate excessively sacrifices the present, and I believe that the figure of 40% is a very balanced number when it comes to one's household finances and goals.

If you continue to invest steadily without rushing, your returns will surely accelerate.

――Are there any things you have decided "never to do" in your investment policy or rules?

The most important thing to be aware of is that you should not try to become rich in a short period of time. Companies also take time to sow the seeds of their business, grow, and generate profits. As a shareholder, you witness that growth while enjoying the profits as dividends. I maintain a mindset of watching over the company's growth in the long term, rather than having a short-term perspective.

I started sharing on SNS X around the same time as my investments, but I have seen many people take excessive risks and drift away from the market. I believe that if you continue steadily without rushing, the returns will accelerate, so I want to continue investing with a long-term perspective.

It is important to keep a record of the dividends received, and seeing them steadily increase contributes to the enjoyment of continuing to invest.

――In terms of my investment history, what would be some of the failures that I would intentionally mention?

In my first year of investing, I couldn't endure the unrealized losses and rushed to sell, or I was overly conscious of the stock prices during the COVID-19 crash, which made me hesitant to buy during the subsequent rise... From that experience, I've made it a point to buy only if I am satisfied with the stock price and not to sell just based on the stock price. Since the second year, I have not made any hasty sales.

――How much time do you usually spend on investing? Please also tell me about the timing in your daily life.

During my lunch break at work, I casually check stock prices and usually buy about 1 to several shares of 2 to 4 stocks each day, so it takes me about 10 minutes at most. I check stock prices about 1 to 3 times a day.

When the market is crashing, it becomes possible to buy at a low price, which increases the time spent on investment as I pay more attention to the market. However, on days when stock prices rise significantly, I end up investing at a higher price than the previous day, so I hardly spend any time on it.

Stock investment is a means to combat inflation

――Finally, if you have any advice for those who are not confident in investing, please share.

I don't think you necessarily have to invest in stocks. There are risks involved, and if fluctuations in stock prices disturb your peace of mind, it might be better not to do it.

However, I have not only been able to accumulate a significant amount of assets through stock investment, but I have also developed the ability to view everything from a long-term perspective, and I feel that I have grown compared to my immature past self.

Thanks to the increasing dividends year by year, my financial worries have disappeared, and I have become more tolerant of career changes and job transitions that may result in lower income. I no longer stress over small expenses, and I can let my children pursue the extracurricular activities they want without worrying about the financial burden.

In the midst of rising prices due to inflation, I must say that it is indeed difficult to build wealth solely through cash. In that sense, I believe that stock investment is a means to counter inflation.

*This content has been edited and published from a mail survey conducted in July 2025.

*This content is based on individual experiences and does not represent our opinion.

*We kindly ask that the final decision regarding your investment be made at your own discretion and responsibility.