Web3_Visionary

Building the decentralized future since 2016. Early investor in 12 unicorn protocols. Connecting founders with capital. Focus on privacy tech, DeFi infrastructure, and cross-chain solutions.

Web3_Visionary

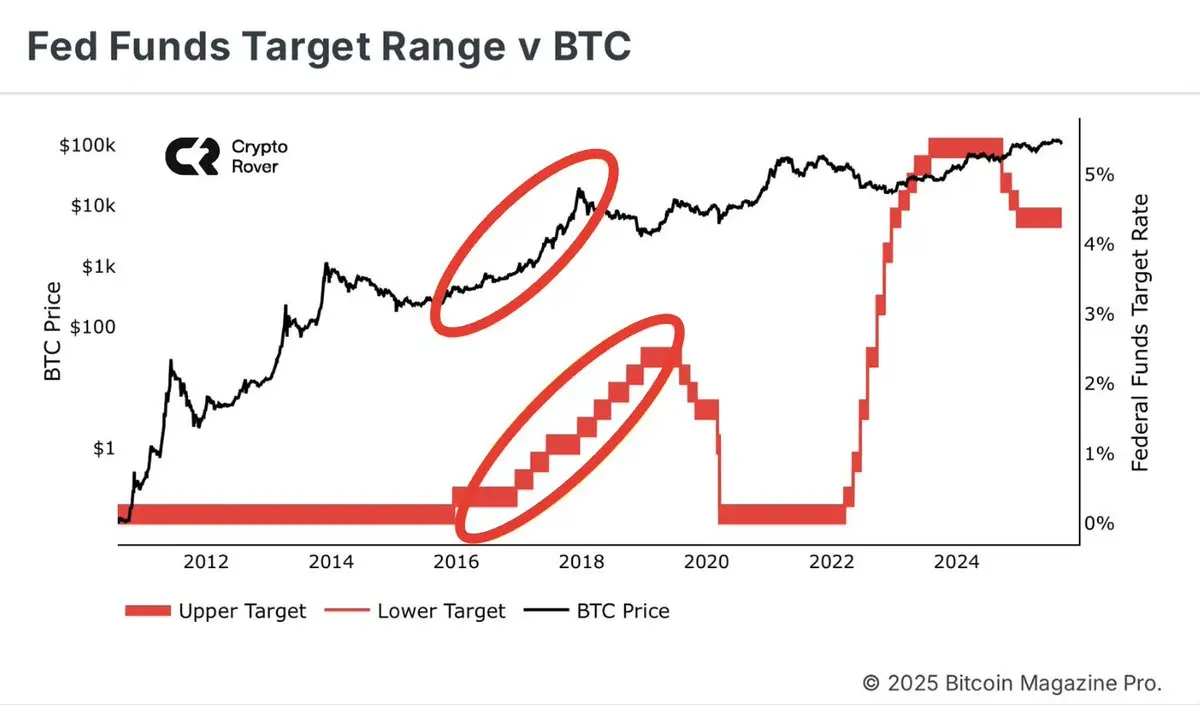

Rate cuts are bullish, right?

- Reward

- like

- Comment

- Repost

- Share

JUST IN: China's central bank extends gold buying spree to 10 consecutive months as it tries to rely less on U.S dollars in its reserve.

IN3.19%

- Reward

- 8

- 5

- Repost

- Share

Anon32942 :

:

The Fed is in a hurry.View More

- Reward

- 11

- 4

- Repost

- Share

BagHolderTillRetire :

:

India is walking the tightrope again.View More

- Reward

- 13

- 5

- Repost

- Share

ValidatorVibes :

:

smh... this is why we need decentralized governance asap frView More

- Reward

- 9

- 7

- Repost

- Share

SatoshiSherpa :

:

when moon sirView More

- Reward

- 10

- 4

- Repost

- Share

SchrodingerWallet :

:

enter a position注水 get out of positions暴雷View More

- Reward

- 10

- 5

- Repost

- Share

ruggedSoBadLMAO :

:

The crypto world will face blood and storm in 2025.View More

We're pricing in rate cuts being sell the news

And they won't be

And they won't be

IN3.19%

- Reward

- 12

- 5

- Repost

- Share

OnchainSniper :

:

Go long! Open it now!View More

Real value is not going up it's just people thinking they're getting wealthy from nominal returns

NOT3%

- Reward

- 7

- 5

- Repost

- Share

ContractHunter :

:

It's just an appreciation of illusions.View More

- Reward

- 8

- 3

- Repost

- Share

ZenZKPlayer :

:

Ah, the reason for the gift delay is here.View More

🚨FED WATCH: September rate cut odds hit 100%, with 11% chance the Fed goes big at 50 bps.

BULLISH!🚀

BULLISH!🚀

- Reward

- 11

- 7

- Repost

- Share

ForkLibertarian :

:

It's a good time to Be Played for Suckers again.View More

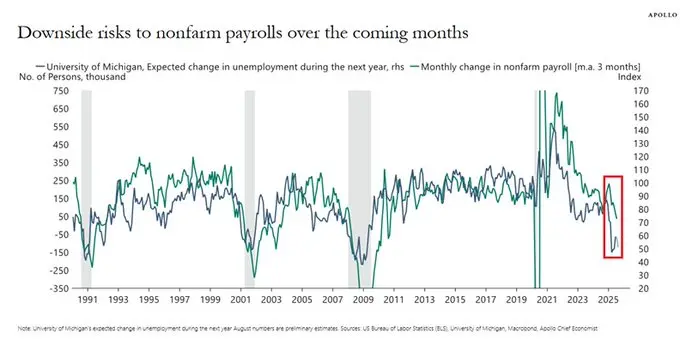

We have changed our approach:

Given the fact that millions of jobs are being revised out of initially reported economic data…

Given the fact that millions of jobs are being revised out of initially reported economic data…

- Reward

- 8

- 2

- Repost

- Share

SolidityStruggler :

:

The data is too inflated.View More

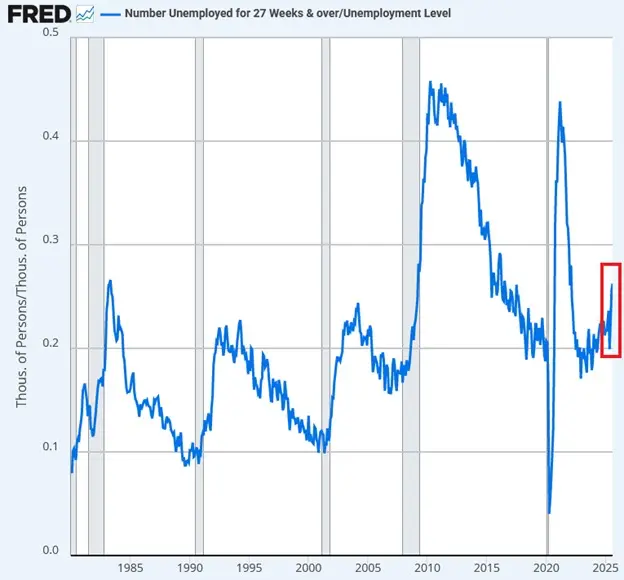

In August, 63% of consumers expected higher unemployment over the next 12 months, the third-highest reading since 2008.

This has been a leading indicator for the job market.

This suggests the 3-month average of payrolls could fall to -50,000 to -100,000 in the coming months.

This has been a leading indicator for the job market.

This suggests the 3-month average of payrolls could fall to -50,000 to -100,000 in the coming months.

IN3.19%

- Reward

- 6

- 3

- Repost

- Share

MetaverseLandlord :

:

The unemployment rate among workers is rising, and even dogs don't love buying houses.View More

What if the rate cuts are priced in and when it happens the markets top?

IN3.19%

- Reward

- 8

- 5

- Repost

- Share

SelfCustodyBro :

:

price in? That's all虚的View More

dxy bounce kills everything. bonds paying 2.57% over stocks says it all

- Reward

- 9

- 5

- Repost

- Share

Lonely_Validator :

:

Buying government bonds without thinking guarantees profit and no loss.View More

- Reward

- 10

- 6

- Repost

- Share

TokenEconomist :

:

actually, the real bottleneck here is monetary velocity, not just rates... let me break down the mathView More

- Reward

- 12

- 7

- Repost

- Share

NestedFox :

:

Spot scarcity is too real, isn't it?View More

disinflation scare

rate cuts

assets rip higher

Inflation figures worsen

real estate cycle tops

4 year bear market begins

rate cuts

assets rip higher

Inflation figures worsen

real estate cycle tops

4 year bear market begins

- Reward

- 6

- 4

- Repost

- Share

LightningHarvester :

:

Bear Market again? Laughing to deathView More

- Reward

- 12

- 4

- Repost

- Share

LiquidityWitch :

:

Don't order anything too expensive for dinner tonight.View More